It’s just a harmless little 25bps rate hike…

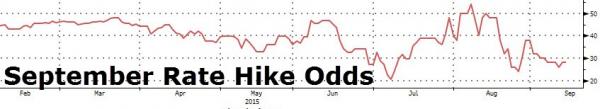

The market’s implied probability of a September rate hike was flat at 28% today…

But today’s weakness started in China when – just as the greater fools thought it was safe to relever into stability – Chinese stocks tumbled most in a month…

Which weighed heavily on an exuberant ‘panic-buying’ US futures market overnight… from the start of Friday’s meltup close…

Cash markets tried an initial squeeze but failed and drifted lower into the European close…

Once again, stocks tracked oil.. .until NYMEX closed…

The Nasdaq remains the only index in the green since the end of QE3…

BABA sums it all up nicely… “trust” the analysts…

VIX and Stocks remain decoupled – which appears like traders lifting front-end hedges (and the underlying exposures) or just rolling hedges (as the curve remains notably inverted)…

Treasury yields could not decided what to do today and traded in a very narrow range… 2Y closed higher by 2bps, rest of the curve closed lower in yield…

The US Dollar closed practically unchanged but followed the sell Asia, buy Europe pattern once again…

Gold was very quiet today but copper, crude, and silver all slipped together from overnight pre-China highs…

But the crude contango is back in force as Brent’s 13th vs 1st spread is now at $9.23 – its highest since February and re-igniting the “storage arb” trade (with a 20% premium over front-month)

Charts: Bloomberg

Bonus Chart: The only chart that matters for The Fed’s “Dow-Data-Dependence”…

Implied probability of September move vs. S&P pic.twitter.com/TL8nuxhgIL

— Not Jim Cramer (@Not_Jim_Cramer) September 11, 2015

Leave A Comment