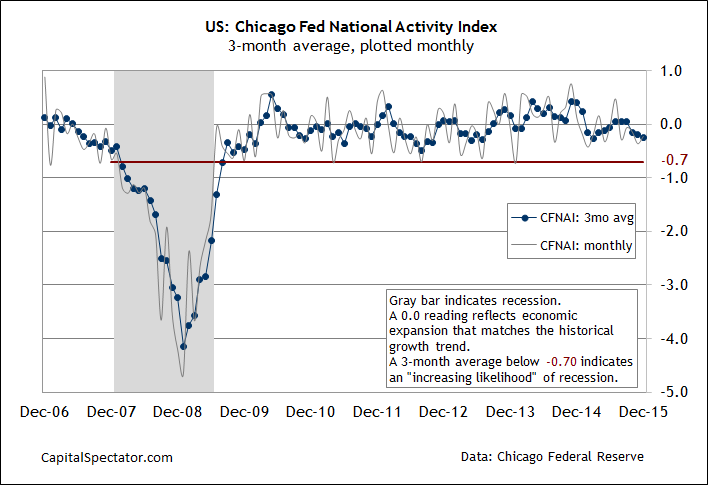

U.S. economic growth continued to decelerate in December, according to this morning’s update of the Chicago Fed National Activity Index. The benchmark’s three-month average (CFNAI-MA3) ticked down to -0.24—the third consecutive month of negative (below-trend) growth and the lowest reading since last March.

Despite the latest deceleration in output, CFNAI-MA3’s current level is well above the tipping point (-0.70) that marks the start of new recessions for the US, based on the Chicago Fed’s guidelines.

“December’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend,” the bank said in a statement. “The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.”

Today’s update offers quantitative support for arguing that the US economy was still expanding at 2015’s close—a message that echoes yesterday’s business-cycle analysis. But while the risk is low that an NBER-defined downturn started in December, it’s also clear that economic output has slowed sharply in recent months.

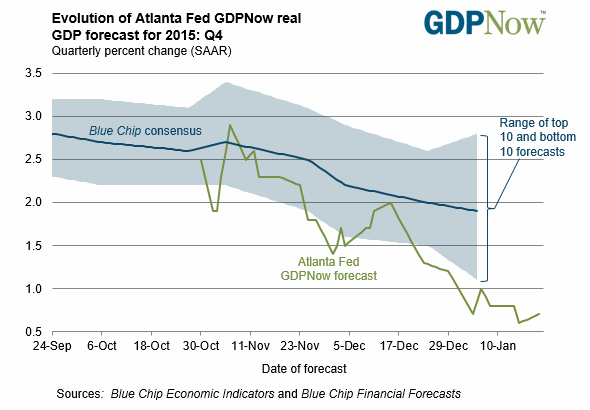

The Atlanta Fed’s GDPNow model is currently projecting (as of Jan. 20) that next week’s “advance” estimate of fourth-quarter GDP (due on Jan. 29) will post a substantial downshift: 0.7% growth from 2.0% in Q3, based on seasonally adjusted annual rates.

The focus now shifts to the January data for deciding if 2015’s year-end stumble accelerates in the new year. The key events for an early read on the kick-off to 2016: ADP’s estimate of private payrolls in January (Feb. 3), followed by the official jobs report for this month via the Labor Department (Feb. 5).

Meantime, Mr. Market is feeling more optimistic this morning. The S&P 500 in the early minutes of trading today popped 0.5%, offering a respite from the otherwise bearish trend this month. The question, of course, is whether the incoming macro data will confirm the newly minted burst of optimism? As usual, an answer that’s based on the data arrives with a lag vs. the crowd’s initial perception. Stay tuned….

Leave A Comment