The odds of a December rate hike have slipped in recent days from over 70% intraday to 64.0% today as, while economists remain convinced that rates will rise in December, traders appear a little less confident. One of the most outspoken – having doubted The Fed (and questioned the economy’s ability to handle even a 25bps rate hike) since Spring – DoubleLine Capital co-founder Jeffrey Gundlach said on Sunday that the Fed may hesitate to raise rates given rocky economic and financial conditions making it clear, as Reuters reports, “certainly [a Fed] No-Go is more likely than most people think. These markets are falling apart.”

as Reuters reports,,

The influential money manager, who recently warned that the U.S. Federal Reserve should not tighten monetary policy in December, said the Paris attacks could pressure stock markets around the globe, “which we know Fed officials have been watching, even if they try not to admit it.”

Gundlach said about a rate hike next month that many economists believe will occur:“Certainly No-Go more likely than most people think. These markets are falling apart.” Los Angeles-based DoubleLine oversees $80 billion in assets under management.

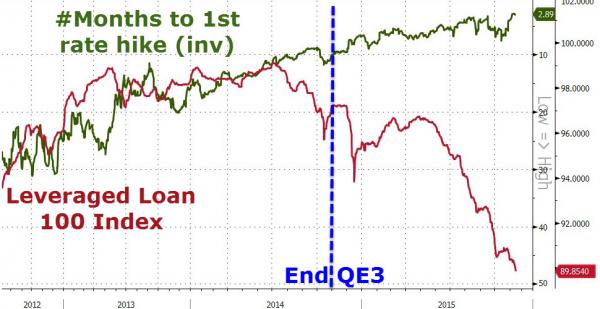

Gundlach cited a number of asset classes that are signaling deteriorating conditions: The S&P Leveraged Loan Index, which is at a four-year low, the SPDR Barclays High Yield Bond Exchange-Traded Fund “very near a four-year low” and the CRB Commodity Index at a 13-year low.

“You also have the Eurozone doubling down on stimulus. Fed raising rates? Really?”

Gundlach said emerging markets may lead developed markets lower against the backdrop of rising borrowing costs, noting that Latin American currencies have crashed and Middle East currencies are down. “No wonder” the yield premium demanded by the markets from emerging markets has been rising, he said.

Since the spring, Gundlach has said the U.S. economy and risk markets cannot digest a premature Fed hike… judging by the data and every market aside from stocks, he is right!

Leave A Comment