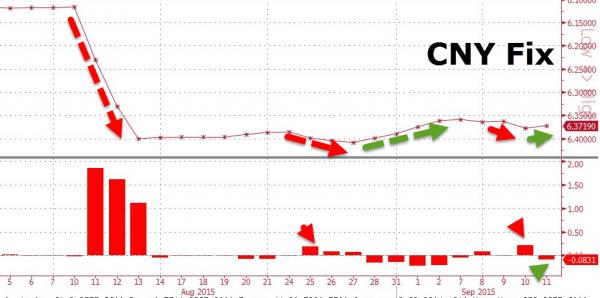

Despite the biggest intervention surge in offshore Yuan on record (“predatoring” any excess speculative fervor on PBOC actions in the spot market), a ‘PBOC Advisor’ noted that “long-term FX intervention was not their target.” The Hong Kong Dollar is pressuring the strong-end of its range against the USD, trapped between the USD peg and weak economy (like so many others). Chinese stocks continue to tread water as China’s Premier Li rules out QE (perhaps because pork prices are already at record high prices and are rising at a record pace), exclaiming that there “well be no hard landing,” but BofAML expected 50-100bps more RRR cuts this year. PBOC strengthened the Yuan Fix tonight (just modestly).

Despite this…

Offshore Yuan surged by the most on record overnight (removing all the devaluation premium)…

After last night’s major devaluation, PBOC strengthens Yuan:

And officials proudly crowed that…

And in other FX news:

China’s Premier ruled out Quantitative Easing since he implored thare will no hard landing.

He said during a speech at the World Economic Forum in Dalian on Thursday that quantitative easing alone could not solve structural problems in economic growth and that it would lead to negative and spillover effects.

*CHINA’S INDUSTRIAL SLOWDOWN MAY BOTTOM OUT SOON: ECO INFO DAILY

Perhaps this is why…

But BofAML says forget Pork.. we need moar… (via ForexLive)

Leave A Comment