Back in the middle of December, I was brought into a group text conversation about – what else – Bitcoin.

“I’m just going to buy it and ride this uptrend for as long as it lasts. What do you think, Charlie?”

My response:

I’m not sure you’re going to like this answer, but here goes…

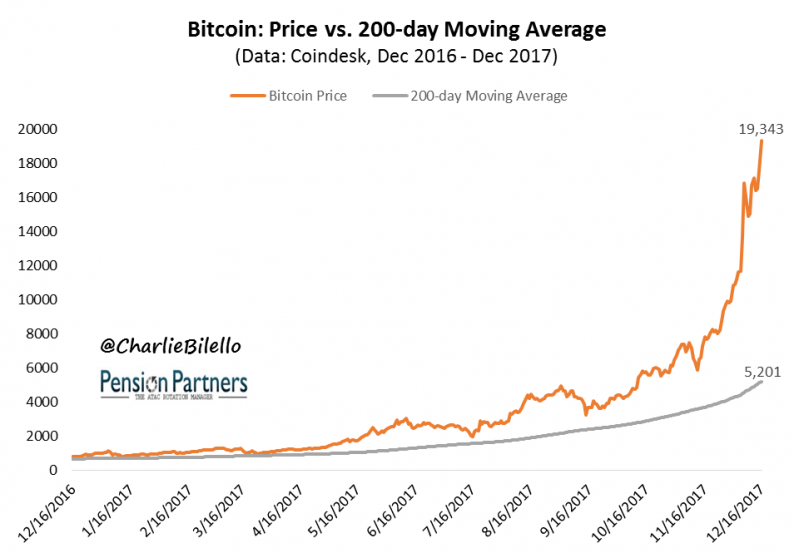

If we define an uptrend as an asset trading above its 200-day moving average, Bitcoin has been in one for over two years now: since October 11, 2015. Over this period of time, Bitcoin has advanced over 7,700%. In choosing to “ride the uptrend” today, you will receive none of these gains but will incur all of the downside risk until the trend changes.

The price of Bitcoin today, $19,343, is 272% above its 200-day moving average of $5,201. That means if you bought today with the intention of holding it until it broke its 200-day moving average, you would have to be willing to lose at least 73%.

Source: Pension Partners, Coindesk

“73%! That’s crazy. How do you figure?”

If Bitcoin were to crash tomorrow and decline 73%, it would break its 200-day moving average and you would (as an avowed trend follower) be obligated to sell. While a 73% crash in one day is unlikely, such declines in Bitcoin over longer periods are not unprecedented:

“But couldn’t I just sell it before it goes down that much?”

Sure you could, but that would be a subjective decision, not trend following. Trend following is supposed to be entirely objective in terms of buys/sells. The buys/sells may be worse at times than your subjective decisions, but that is the nature of a systematic strategy.

“This all seems really complicated. Everyone seems to be getting rich without knowing anything more than HODL.”

Leave A Comment