Is the dead cat bounce over?

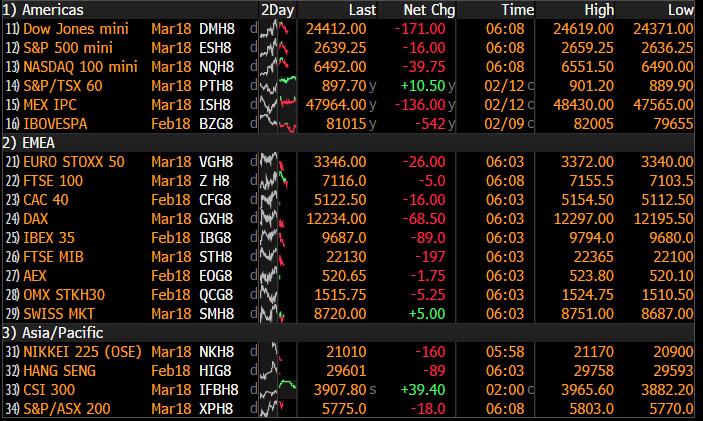

European shares rolled over this morning after a late downswing in Asia as markets struggled to find stability despite Monday’s frenzied rally, with futures this morning a bit of a mess.

“I think what we are seeing is a little bit of a consolidation,” said DZ Bank strategist Christian Lenk. “Given the pace of the move so far, we had to take a break somewhere and we have reached that region now.”

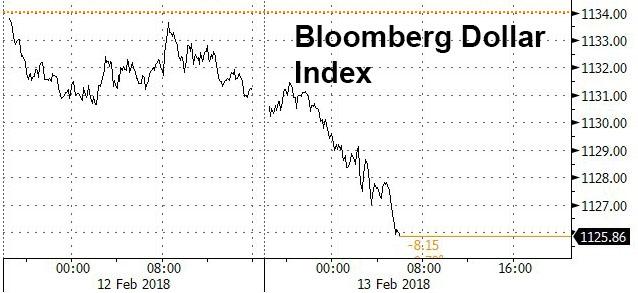

While there has been no specific driver, USD weakness for the third day in a row, and a consequent selloff in USD/JPY – which tumbled shortly before midnight ET – was the main focus in European session.

The resultant surge in the yen, which climbed to the highest since November 2016 pushing the USDJPY as low as 107.40, slammed the Nikkei after the midday break in Asia, with Trump comments on reciprocal tax yesterday also potentially having an influence on USD. Whatever the reason, Japanese stocks pared morning gains with Topix erasing 1.1% advance to trade 0.9% lower on the day. And with the USDJPY nearing the 2017 low of 107.32, Nikkei futures sold off further after the cash close.

At the same time, the EUR/USD lifted to 1.2350 mainly due to move in USD, while the British pound was briefly jolted to a session high of $1.3924 after headline annual UK inflation came in at 3.0%, a tenth of a point above forecasts and holding close to its highest level in nearly six years. In South Africa, the ZAR dipped briefly after President Zuma was said to refuse ANC’s resignation call.

Pressured by the weaker dollar and sliding European stocks, S&P 500 futures pointed to a drop for U.S. stocks at the market open after two days of gains.

The 10-year Treasury yield fell back to 2.83% after touching 2.902% on Monday. The general risk-off lifted core fixed income, U.S 2s10s flatten away from 200DMA after testing level for the third day.

German bonds were also back in demand as recent multi-year highs on yields on both sides of the Atlantic proved attractive for some investors. Germany’s 10-year yield fell by almost 2 basis points to 0.73 as it retreated further from the 2-1/2 year high of 0.81 percent hit last week.

Leave A Comment