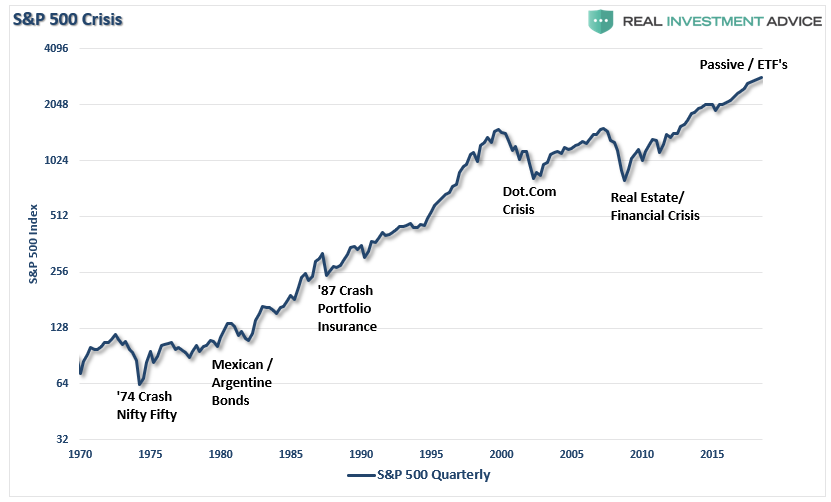

Last week, investors received a “warning shot” about the dangers of “passive indexing.”

While the idea of “passive indexing” sounds harmless enough, we have spilled a lot of ink on this site digging into the relative dangers of it.

The biggest risk to investors is when “passive indexers” turn into “panic sellers.”

We witnessed it all first-hand last week.

The “sell off” proved our previous premise of the flaws of “passive investing.”

“While it is believed ETF investors have become ‘passive,’ the reality is they have simply become ‘active’ investors in a different form. As the markets decline, there will be a slow realization ‘this decline’ is something more than a ‘buy the dip’ opportunity. As losses mount, the anxiety of those ‘losses’ mounts until individuals seek to ‘avert further loss’ by selling.”

I have also stated that while “robo-advisors” are the new “shiny toy” for the markets to play with, and inexperienced investors to be lured into, when a crash does come, individuals will not be willing to just “ride it out.” To wit:

“The websites of two of the country’s biggest robo-advisers — Wealthfront Inc. and Betterment LLC — crashed on Monday as the S&P 500 Index sank. Complaints quickly spread across Reddit and other internet sites from people who had trouble logging onto their accounts.”

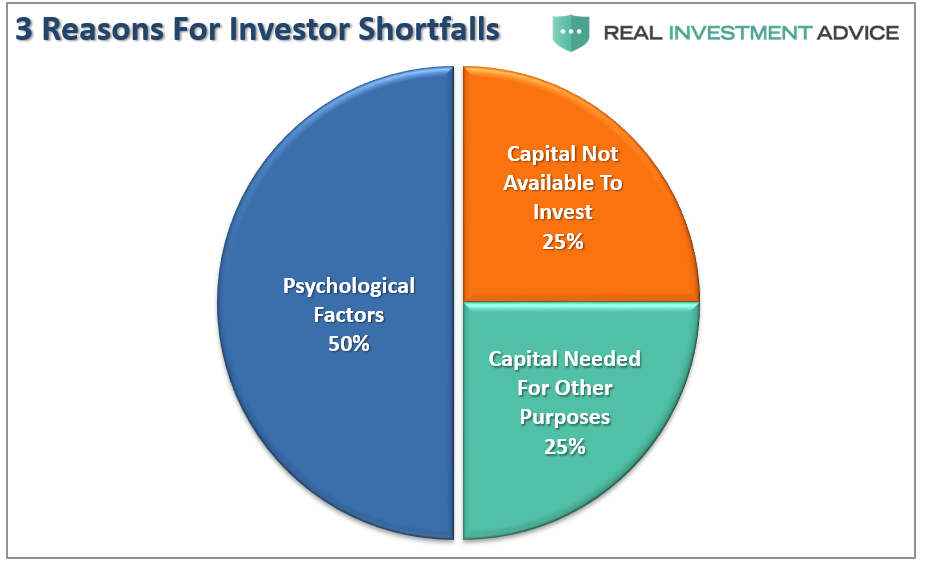

Yea….it’s that psychology thing.

Individuals just simply refuse to act “rationally” by holding their investments as they watch losses mount.

This behavioral bias of investors is one of the most serious risks arising from ETFs as the concentration of too much capital in too few places. But this concentration risk in ETF’s is not the first time this has occurred:

Risk concentration always seems rational at the beginning, and the initial successes of the trends it creates can be self-reinforcing.

Leave A Comment