Gold prices ended Wednesday’s session down $3.30, to settle at $1086.29 an ounce as speculation that the U.S. Federal Reserve was on track to hike interest rates at its December policy meeting, unless the economic data deteriorates significantly, weighed on the market. The return of stronger job growth last week dampened earlier talk that lagging inflation and global growth concerns could dissuade the central bank from rushing to normalize policy. The XAU/USD pair is trading slightly higher at $1088.06 in Asian trade on Thursday but we are still stuck within the range of the past 3 sessions.

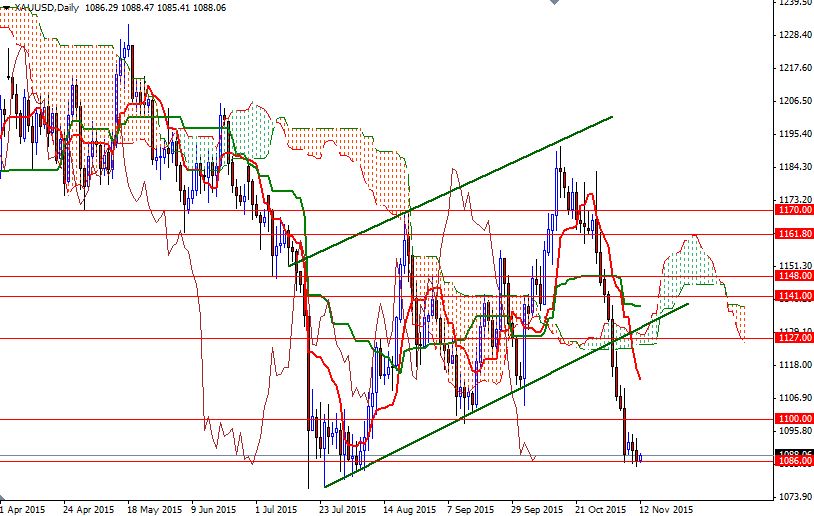

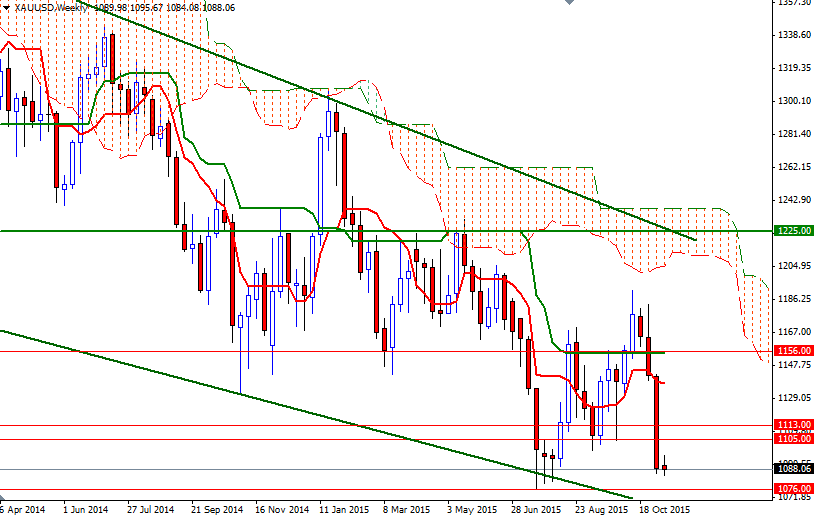

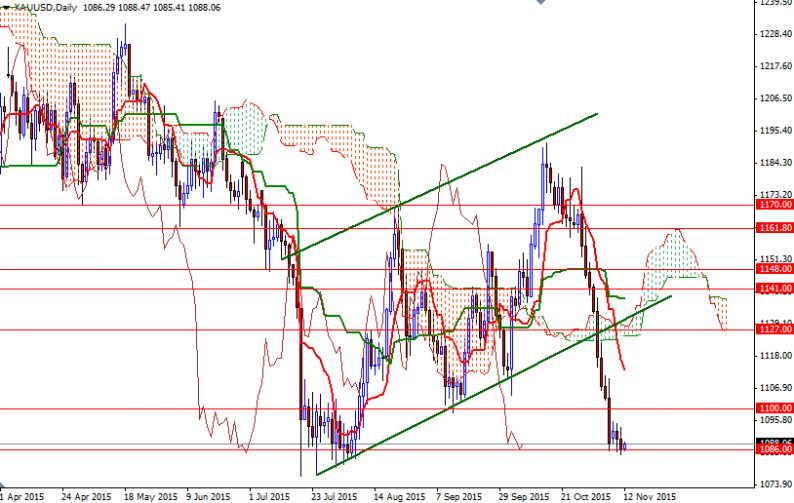

Looking at the weekly and daily charts from a purely technical point of view, the odds favor the bears in the long term. The market is trading below the Ichimoku clouds on both time frames and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) lines are negatively aligned. However, the market is oversold and as I said earlier in the week the area between the 1082 and 1105 will probably contain the market in the short-term.

The upward potential is likely to be limited by the resistance at 1105. But of course, in order to challenge that barrier, the bulls will have to clear the 1096 and 1100 resistance levels. Only a daily close above 1105 could provide the bulls extra momentum they need to test the 1113/0 region which is the first major resistance. On the other hand, as long as this strategic resistance is not surpassed, the risk of a break below 1086/2 remains high. If XAU/USD dives below this area, then prices will possibly fall to 1076/4 before finding some support.

Leave A Comment