Back On May 19, ECB executive board member Benoit Couere caused a scandal of heretofore unseen proportions, when it was revealed that he had disclosed European central bank policy in private to a group of hedge funds almost 12 hours before the ECB publicly revealed a substantial shift in QE policy, namely that the central bank would front-load its program in May and June while slowing down monetization later in the summer.

The result was millions in profits to those hedge funds who had acquired the information about ten hours ahead of the public, and shorted the EURUSD appropriately:

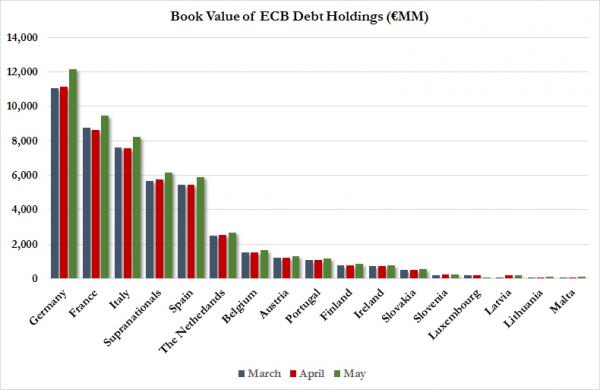

Sure enough, a few weeks later we found out that the ECB had done precisely as it had originally leaked to the “smartest people in the room”, when it was revealed that in May the ECB had bought about 9% more in government bonds among the key issuers: Germany, France, Italy and Spain.

Fast forward three months, when earlier today we received the latest ECB asset-buying update, and just as the ECB has warned, after a brief surge period early in the summer, monetization under the ECB’s Public Sector Purchase Programme tumbled in August, when the ECB monetized just €42.8 billion in Eurozone bonds, down 17% from the €51.4 billion the month before, and the lowest full-month since the start of the ECB’s QE in March of this year.

Adding €7.5 billion in covered bonds and €1.3 billion in ABS purchases, took the monthly total to just €51.6 billion, far below the ECB’s stated goal of monetizing €60 billion in securities each month, and is well below the May and June peak totals of €61 and €63 billion, respectively.

From Bloomberg:

The European Central Bank’s asset purchases last month slowed to the weakest since quantitative easing started in March as liquidity dried up during Europe’s summer holiday period.

While the Frankfurt-based central bank intends to buy 60 billion euros a month of debt through September 2016 to revive euro-area inflation, it has repeatedly said the program can be adjusted to take account of market conditions. Purchases were frontloaded before the summer and ECB President Mario Draghi has signaled that the same strategy may be used before December.

Draghi also said last week that the size, composition and duration of the QE program can be altered if needed for the ECB to reach its goal of returning medium-term inflation to just under 2 percent. Consumer prices rose an annual 0.2 percent in August and the euro-area recovery risks being undermined by a China-led slowdown in global growth, spurring speculation that the ECB may need to ease monetary policy further.

Leave A Comment