by John Lin, Alliance Bernstein

As the Chinese New Year approaches, investors will welcome the year of China A-shares, soon to be included in the MSCI emerging-market (EM) benchmarks. But put careful consideration into determining which funds are actually ready to join the festivities.

Index provider MSCI plans a gradual integration for the vast onshore market, whose $8.3 trillion market capitalization is second only to that of the US. Though A-shares will initially account for just 0.7% of the MSCI Emerging Markets Index, it’s a major step toward assimilating China’s vast onshore equity universe into global capital markets. At full inclusion of 500 stocks, A-shares are likely to account for more than 20% of the benchmark, according to many sell-side estimates. Over the long term, the index revisions are expected to unleash $100 billion of investment in A-shares through EM vehicles.

Increasing Exposure to Chinese Markets

But are EM funds ready for the change? Overseas investment funds have been increasing exposure to China, according to a recent Bloomberg report. Yet even though 87% of mutual and index funds invest in Chinese equities—and some A-shares are already accessible—their holdings remain concentrated in offshore H-shares, traded in Hong Kong, and US-listed American depositary receipts (ADRs).

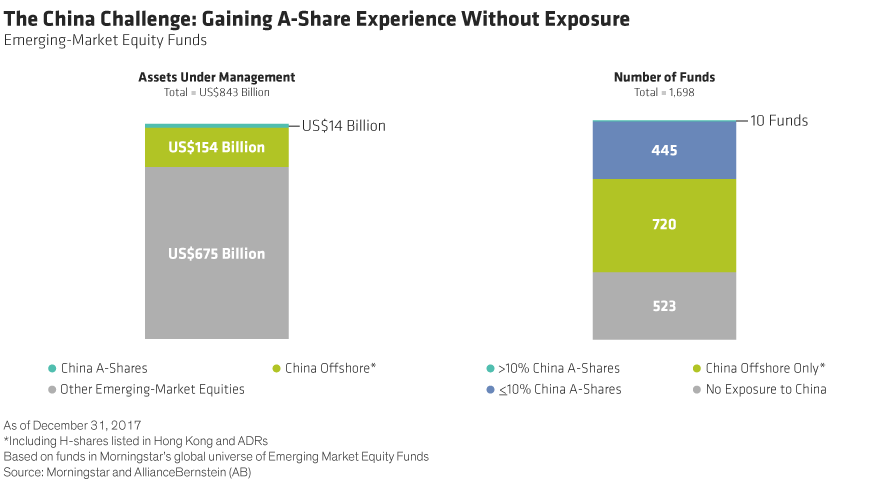

Nearly three-quarters of the funds don’t hold any onshore shares. China A-shares account for only US$14 billion (or 1.7%) of assets under management in EM funds (Display, left). And only 10 EM funds hold more than 10% in onshore equities (Display, right).

There are good reasons to be cautious about A-shares. Investors need to navigate structural imbalances in China’s debt-laden economy, concerns about the government’s macroeconomic stewardship and the large contingent of state-owned enterprises in the market.

Ignoring A-shares, however, means missing the full potential of China’s expansion. For example, the onshore market is full of growing healthcare companies serving the country’s aging generation. Many technology firms from the Shenzhen market are inaccessible offshore. The market also provides access to China’s explosive consumer growth and local brands popular with the growing middle class; shares of Kweichow Moutai, the distiller of a popular grain liquor, more than doubled on the Shanghai Stock Exchange over the last 12 months due to swelling demand.

Leave A Comment