Last month, we highlighted the common bond between the stocks that delivered big returns in the market crash of 2008. We saw that companies that earned a consistently high return on invested capital (ROIC) were the only ones to survive unscathed.

While it’s unlikely we’re in for a repeat of 2008, recent volatility will certainly have investors wondering how to protect their portfolio in the event that our 7-year bull market has ended, and we’re in for a significant downturn.

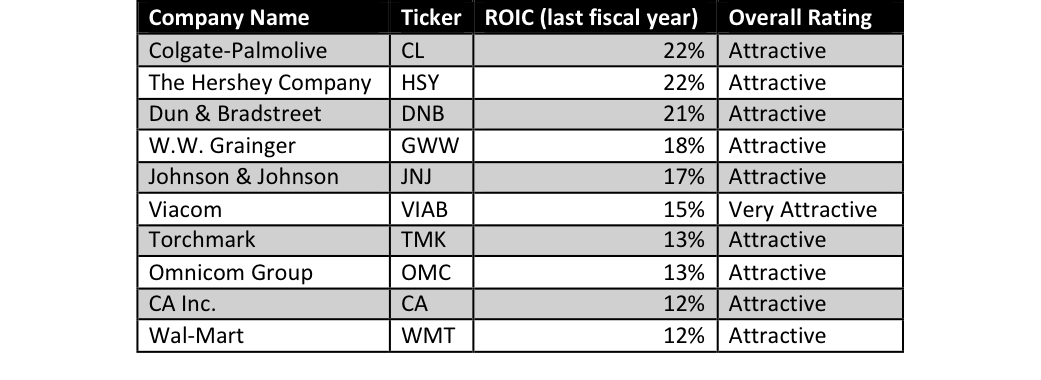

With that in mind,

Figure 1: Best Stocks For A Bear Market

Sources: New Constructs, LLC and company filings.

Viacom (VIAB) is our top-ranked stock on this list, and the only one to earn our Very Attractive rating. We’ve liked VIAB for a long time, recommending it to investors back in 2012. Since then, the stock has been on a roller coaster ride, gaining almost 75% between our first article and its peak in early 2014 before crashing back down by 50%.

The recent decline is due in part to concerns over cord-cutting and increasing competition for ad dollars, as well as questions over the health of executive chairman Sumner Redstone, who owns 80% of the company’s shares.

These fears mask the fact that Viacom’s business continues to thrive. When we remove the impact of one-time write-downs and restructuring charges, we see that VIAB actually grew net operating profit after tax (NOPAT) by 7% in 2015 and increased its ROIC for the fifth straight year.

Make no mistake, this remains a very strong business. The continual improvement in ROIC shows that cord cutters are not hurting it as much as investors believe, and while Redstone’s health is a concern, he has not been heavily involved in running the business for several years now.

Leave A Comment