Both poker and investing are games of incomplete information. You have a certain set of facts and you are looking for situations where you have an edge, whether the edge is psychological or statistical.

– David Einhorn

David Einhorn has returned over 19% on an annualized basis since he launched his fund. He famously understood and exploited the precarious and risky nature of Lehman Brothers before it collapsed in a fiery wreck. He wrote one of my favorite books, which I strongly recommend to anyone interested in better understanding the nature of short selling.

One of the largest positions at his fund, Greenlight Capital, is in SunEdison (NYSE:SUNE). He owns about 25 million shares. The market has punished the shares, especially after their acquisition of Vivint (NYSE:VSLR) was announced. SUNE’s management may have to extract themselves from the deal or convince the market of its merits in order to salvage their year. He has also recently added to a SUNE spin-off,SunEdison Semi (NASDAQ:SEMI); he owns 3.7 million shares after recently increasing his stake by over one-third. Other notable positions include Yahoo! (NASDAQ:YHOO). Einhorn owns over two million shares. Over the course of the past quarter, he sold his positions in EMC (NYSE:EMC) and Nokia (NYSE:NOK).

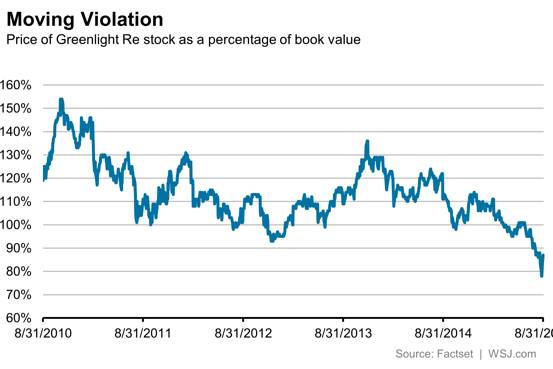

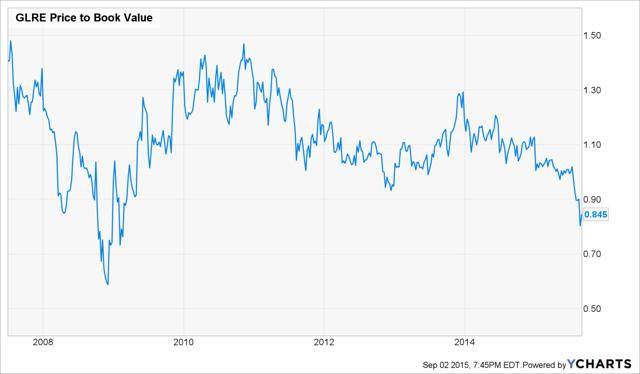

One way to get convenient exposure to Einhorn at a discount is via Greenlight Capital Re (NASDAQ:GLRE), a property and casualty reinsurer holding company that invests alongside Einhorn’s hedge fund.

One way to take advantage of this price discount is via equity options. For example, you can write February 19, 2016 $25 puts which last traded for $2.10 with a bid of $1.35 and an ask of $2.85. At the last price, this contract makes the writer indifferent at a price equal to 77% of GLRE’s book value.

Relative to book value, this is the best opportunity since the financial crisis in 2009.

According to the company,

Leave A Comment