Fibonacci levels are used in technical analysis to assess the probability of a financial asset retracing its original move in price. The Fibonacci ratios utilized are 23.6%, 38.2%, 50%, 61.8%, 100%, 161.8%, 261.8%, and 423.6%. When connecting an extreme high and an extreme low price point of a financial asset, the Fibonacci ratios more often than not represent future support and resistance levels.

Take the recent move in the S&P 500 as an example.

Click on picture to enlarge

The Fibonacci levels of the 2007 high and the 2009 low created many points of support and resistance that have been continually tested during this 6 ½ year bull market, with the 161.8% retracement level being the most recent level tested.

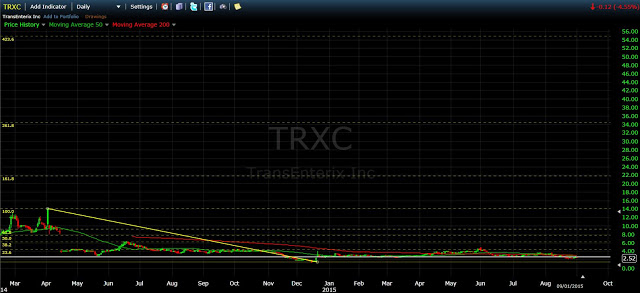

TransEnterix (TRXC) has an extreme high and an extreme low that is ideal for Fibonacci analysis. After completing their reverse merger with Safestitch Medical, the stock briefly jumped to $14 per share on thin volume in early 2014. A few months later, the stock sold off to $1.40 on news that the SurgiBot would be delayed by six months. A total drawdown of 90%.

Click on picture to enlarge

Utilizing the extreme high and low of TransEnterix for Fibonacci analysis yields these retracement levels:

Leave A Comment