Today’s December updates on retail sales and industrial production for the US delivered disappointing news. Negative comparisons weighed on both indicators for last month, raising more doubts about the strength of the US economy. There’s also a bit of good news on the margins in the year-over-year comparisons. Nonetheless, it’s hard to overlook the deterioration in these numbers as last year came to a close.

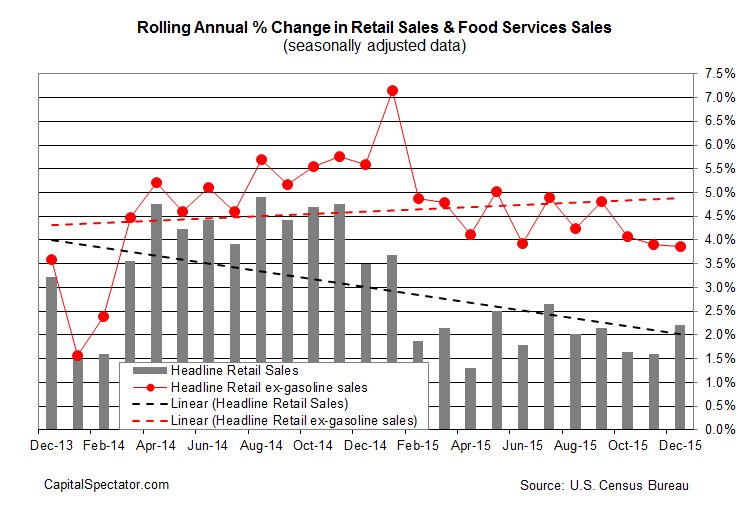

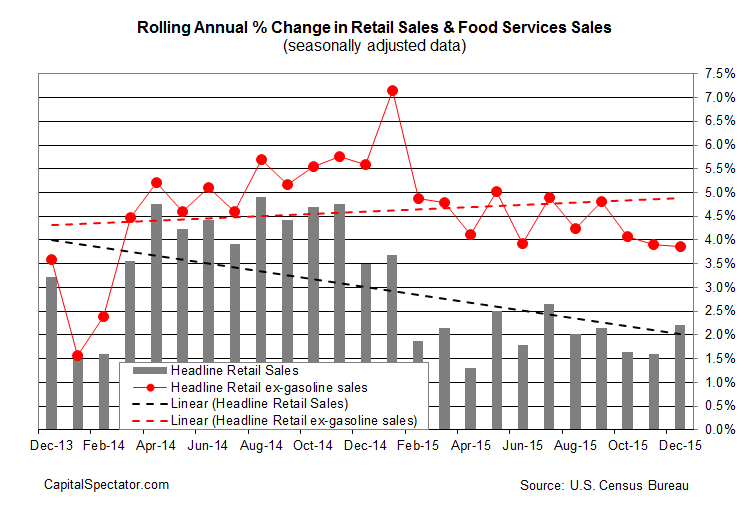

Let’s start with retail spending. Last month’s 0.1% decline marks the first monthly setback since September. The good news is that the year-over-year pace picked up for headline spending. Retail sales rose 2.2% in December vs. the year-earlier level—the strongest annual advance since July. Meanwhile, stripping out gasoline sales reveals that spending climbed 3.9% in annual terms last month, roughly in line with the year-over-year gain in the previous month. The stability in spending ex-gas reflects a degree of resilience that’s not obvious in the monthly comparison.

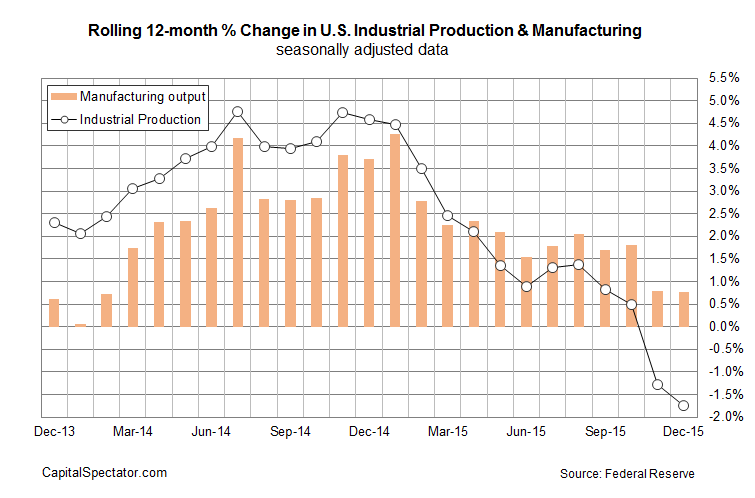

Moving on to industrial production, output fell 0.4% in December–the third monthly decline in a row. In contrast with retail sales, the year-over-year comparison is negative for the industrial sector, and sinking deeper into the red. Production fell 1.8% for the year through December, marking an acceleration vs. the decline posted in November, which delivered the first round of red ink in annual terms since late-2009.

Note, however, that the manufacturing component for industrial activity is still posting a year-over-year gain for December. The annual growth for manufacturing is weak, but it’s stable at +0.8% for the second month in a row. That’s a tepid gain, but it could be a clue for thinking that output will stabilize in the months to come.

Grasping at straws? Perhaps. But given last week’s strong numbers for nonfarm payrolls in December, it’s premature to assume the worst for the US economy.

Leave A Comment