Yesterday we reported something disturbing: a small regional bank, BOK Financial, announced that it had underestimated its exposure to energy loans, or rather loan, issued by just one company, and as a result its previously forecasted provision for credit losses of $3.5 million to $8.5 million would be insufficient, and due to the unexpected loan impairment it would have to take a dramatic $22.5 million in credit losses.” As a result BOKF stock crashed and is now trading at levels not seen since 2010.

The reason this is troubling is because as we said yesterday “banks have taken every possible opportunity to assure investors they all overly provisioned for any potential losses stemming from their exposure to impaired energy loans.”

Clearly when it came to at least one lender this was not the case. And now the attention shifts to all the other banks, which brings us to the first big bank to report earnings earlier today, JPM.

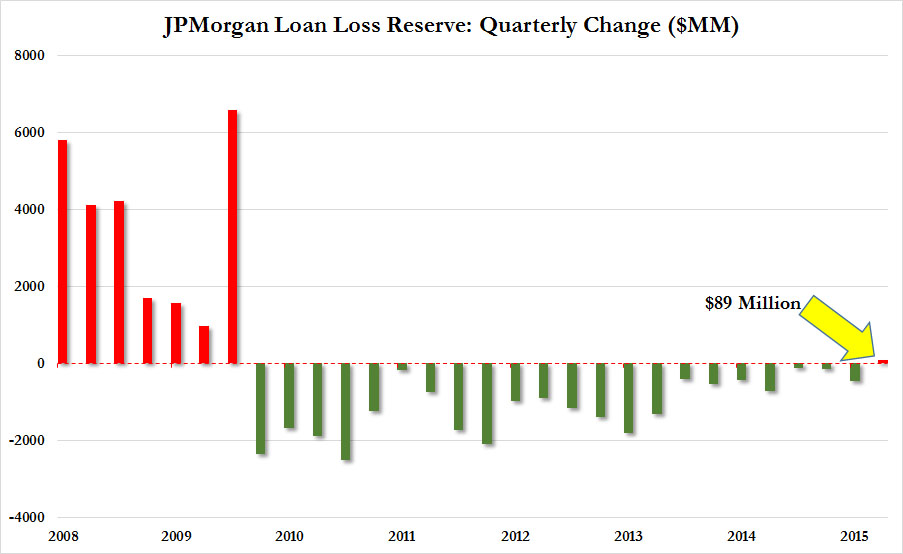

Earlier we spread the company’s financials and showed that while revenues had barely grown, and in the all important Investment Banking and Trading division revenues actually declined (offset with big cuts to compensation expenses, read bonuses), something else stood out: when skimming through the company’s loan loss reserve disclosure, we found that in Q4 JPM did something it hasn’t done in 6 years: for the first time in 22 quarters, or since March 2010, JPM actually increased its loan loss provisions by $89 million, instead of reducing this amount.

Indicatively, after peaking at $38.2 billion in Q1 2010, the amount of loan loss reserves had declined by $24.7 billion (an amount that went straight to JPM’s net income line) through Q3 2015, before rising for the first time in 6 years in the fourth quarter.

What happened?

As JPM disclosed in its earnings presentation, it had taken a “reserve build of ~$100mm driven by $60mm in Oil & Gas and $26mm in Metals & Mining” within the commercial banking group.”

Leave A Comment