Behind our new paywall, I have been documenting the behavior of “dollar” money markets as they relate to China and elsewhere (global, general liquidity) but recent data in repo demand a more open airing. There are numerous indications that US$ markets are a total mess, none more so than repo. That starts with GC repo rates that remain above the effective federal funds rate, but below LIBOR. One of those rates must be “wrong”, and that doesn’t preclude the possibility that they all are. Secured vs. unsecured is a hierarchy; repo should trade lower than unsecured federal funds. If repo is more suited to where LIBOR currently is, then federal funds is fragmented and itself a mess.

It is repo fails, however, which make a complete mockery of everything that the FOMC claims top to bottom; the RRP, IOER, normalizing behavior, all of it. Fails data disproves almost everything about the money market regime the FOMC has fictionalized, and it tells us a great deal about why things are the way they are right now. This is not just about the Fed’s ability to control some rate corridor during its exit program, it is more basic and concerning in that the Fed, once more, proves it doesn’t understand modern money and banking, and thus the very agents it assumes will provide its mechanism for imposing control and order. The implications of that are dire; from everything about assumed “currency elasticity” to renewed fragmentation as money markets are not a singular mass.

Start with the RRP itself; it was supposed to have a dual role in setting a money market floor and providing at least an emergency measure of collateral distribution for repo (especially via non-bank channels). The floor has been violated on several occasions, including three of the last five trading days (why would you lend unsecured in federal funds at 22 bps, as someone did on Monday, when you could “lend” at 25 bps to the Fed secured by UST’s in the SOMA?). But in terms of a more vital function, the lack of RRP usage as a collateral scheme is completely damning.

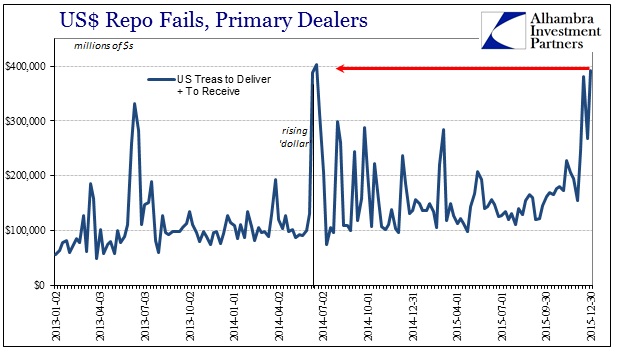

Despite the FOMC’s promises to open up all of the unaccounted SOMA holdings (no a priori cap), repo fails in the latter half of December reached highs not seen since June 2014 and the announcement of the opening act of this still-unfolding “rising dollar” tragedy.

If RRP were an effective alternate means of distributing collateral, we should see no such surge in repo fails; not least of which is because fails are effectively a -3% repo rate spread across hundreds of billions in repo trades. Again, the repo conditions in December were as bad as June 2014, which undoubtedly signaled the start of the money market disruption that is called the “rising dollar.” And that makes this mess in December 2015 all the more maddening, because the RRP was under full testing parameters at that time; meaning the Fed knew it didn’t really work as intended. That period included the end of Q3 2014 and then the clear and global funding disruption (shock) that presented itself just two weeks later in the events of October 15, 2014.

Leave A Comment