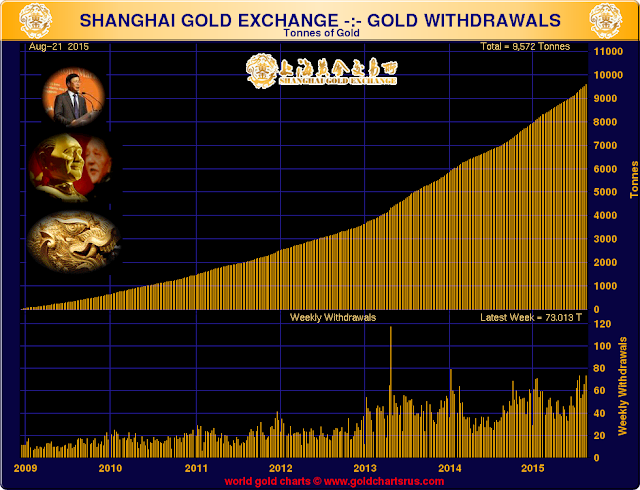

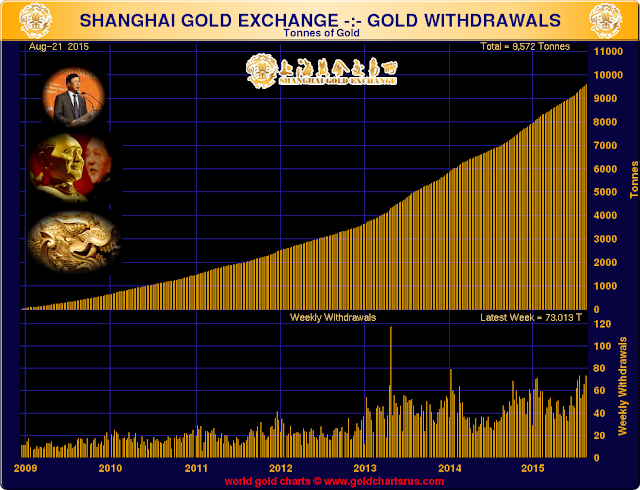

There were a little over 73 tonnes of physical gold withdrawn from the Shanghai Gold Exchange in the week ending August 21st.

This is the 4th largest withdrawal of bullion in its history.

It is hard to tell what exactly is going on in such a dodgy, highly leveraged market, with its determined attempts to keep the price knocked lower so often during the late London to NY trading hours.

But I am sensing a change in the market, and more things running under the surface than meets the eye.

Goldman is no major player in the gold bullion market, but it did strike me as odd that they are suddenly stopping large amounts of bullion for their own house account this month. It is not that they are a player in gold, because they are not. But that they are wired into many sources of information, are good at spotting trends, and are more like a hedge fund, comfortable running on the edge of the markets.

And the gold chart, for what it is worth in these times of market interventions, seems to be trying to form a rounded bottom in the form of a cup and handle, with a successful retest of the handle this week. This calls out a price around the bottom of the old trend channel at 1270.

It could also be nothing. I will pursue the details of such a chart formation if we see the right kinds of follow through next week.

And I will certainly be watching silver very carefully for any signs of life. It may be pivotal next month.

Let’s see what next week brings. Gold is just one market among many, and it is certainly not the largest one in play.

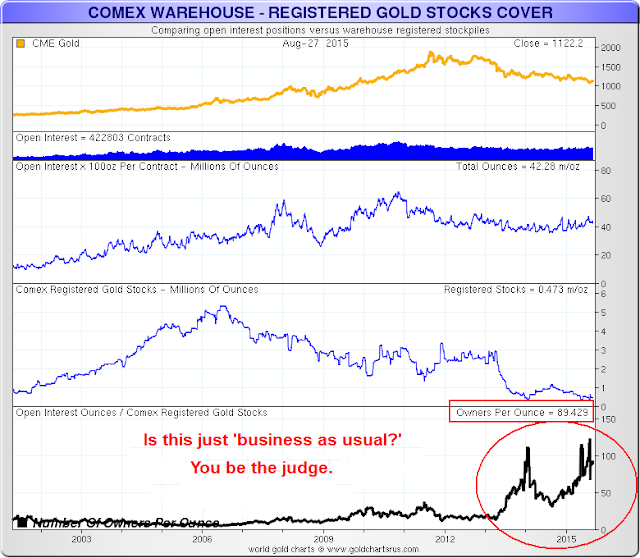

And while I have your attention, I thought I would include a long term chart of the relation of deliverable gold at current prices to open interest. It might mean nothing. But it doesn’t seem to be anything familiar before 2013.

The charts below courtesy of data wrangler Nick Laird at goldchartsrus.com.

Leave A Comment