With Janet Yellen’s testimony behind us, the next big focus for the forex market will be the European Central Bank’s monetary policy meeting. After rising to a 1 year high of 1.1490, EUR/USD struggled to extend its gains above 1.15. Investors worry that Mario Draghi will disappoint in the same way as Janet Yellen. Draghi’s comments last month took euro to a 1 year high versus the U.S. dollar and now everyone will be tuning into the ECB press conference to see whether his hawkishness is repeated or downplayed. We believe that the European Central Bank has already set the course for their next policy change. Its no secret that they prefer to prepare the market for major changes and that is exactly what they are doing now. The ECB is getting ready to taper, or reduce bond buying and Draghi will most likely use next week’s meeting as a platform to reinforce those plans. Eurozone data has been healthy with retail sales, manufacturing and service sector activity improving across the region. Inflation is a bit of a problem but stronger economic activity should naturally lead to higher prices. The only problem is the currency, which is up 8.5% year to date and the appreciation over the past month hurts inflation and export activity. With that in mind, we expect EUR/USD to test and possibly break 1.15 on Draghi’s optimism.

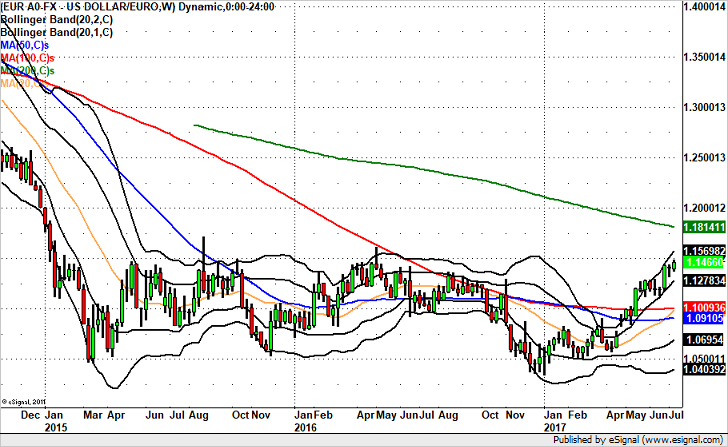

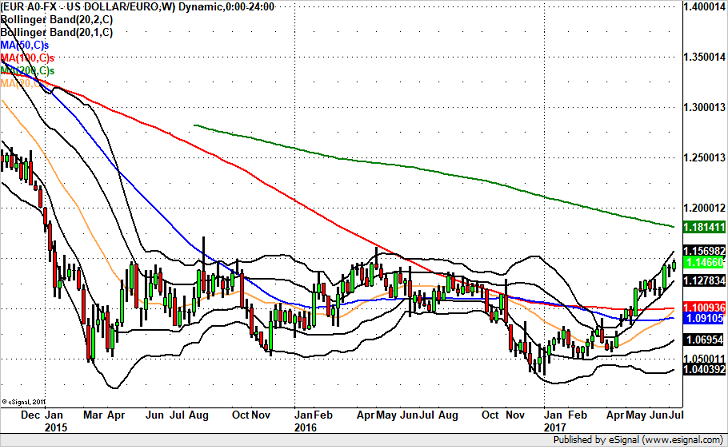

On a technical basis, a break of this key level also appears very likely especially given the strength of Friday’s move. 1.15 is a significant level but above there, the next stop should be the May 2016 high of 1.1616. On the downside, EUR/USD has support at 1.1370, this past week’s low followed by the 20-day SMA near 1.1330

Leave A Comment