While the major stock indices remain near their record highs and show no sign of having their first 5% correction in a few months, there has been changes to the underlying drivers of equities. The changes afoot are that fiscal policy must replace monetary policy in supporting the market and that earnings growth is going to have to replace multiple expansion in boosting stocks since interest rates may be rising.

The Fed chose, for now, to maintain its $4.5 trillion balance sheet, but it’s raising rates finally as we enter a more traditional tightening cycle. According to the Fed’s guidance, it will raise rates 75 basis points this year and next year. It expects to eventually get up to about 3% where it will maintain rates. The Fed has the unrealistic expectation that nothing will go wrong in this process as unemployment will stay at 4.7% indefinitely. The Fed wouldn’t need to meet if these expectations were realized.

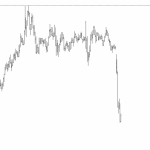

I say these expectations are unrealistic based on historical precedent. As you can see from the chart below, ten out of the past thirteen tightening cycles have led to recessions. The Fed is about one-quarter of the way done with its hikes for this tightening cycle and economy is already very weak as the Atlanta Fed GDP model is expecting 0.9% growth in Q1. The Fed doesn’t want to start the next recession with the Fed Funds rate between 0.75% and 1.00% like it is now because it will have almost no wiggle room to cut rates to help stabilize the economy. The next recession, which the Fed doesn’t see coming, will be bigger than the previous two because of how low-interest rates were kept for such a long period. The cuts won’t be able to help the economy and QE4 will need to be implemented.

As I said, unless you’re expecting stocks to live off hope forever, earnings must grow to bring stock prices higher, given the potential for higher interest rates. If the economy grows faster than expected, interest rates will rise which will crimp multiples. If the economy grows slower than expected, it will be tough for earnings to rise unless record high margins are achieved. The best- case scenario would be a Goldilocks one where the economy grows at about 3% in 2017 while interest rates don’t rise too fast.

Leave A Comment