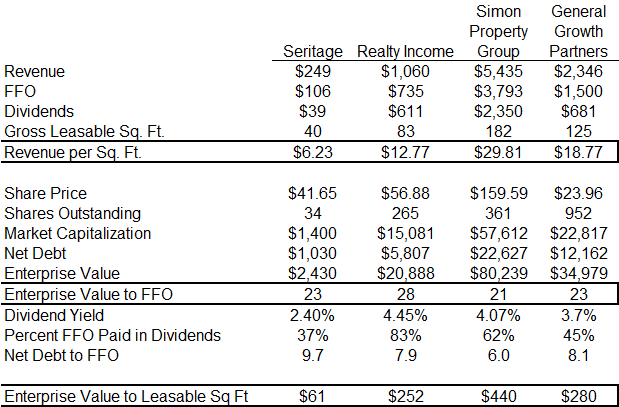

When Seritage Growth Properties (SRG) was spun out of Sears Holdings in 2015, it had two forces working against it – a large portion of their leases were with Sears and KMart and alarms have sounded about the future of the shopping mall and brick and mortar retail as e-commerce sales take an increasingly bigger portion of the retail pie. Seritage may overcome these obstacles, but if it does so it will need to flawlessly execute a transformation of its real estate portfolio to modern uses and amongst a diversified client base.

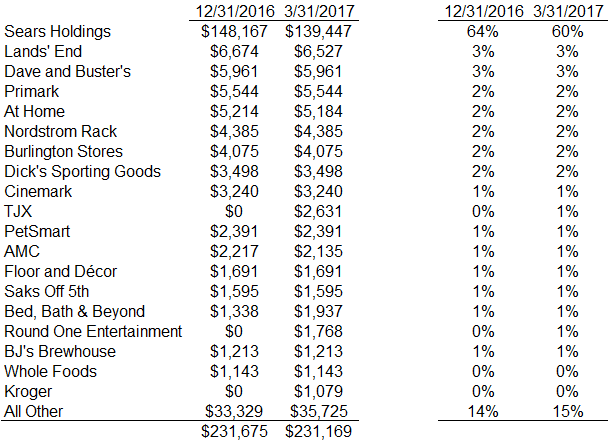

Seritage has already made good progress in finding new tenants. At the time of separation from Sears, 86% of its rent came from its former company. Today the figure is down to 60%.

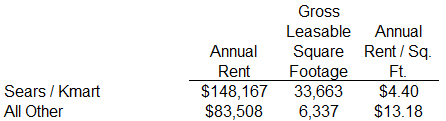

Seritage’s diversification matters not just for reducing a single-tenant risk, but because once Sears closes a store and Seritage develops the property, it can charge meaningfully higher rents. Last year, Sears paid Seritage rent of $4.40 for every square foot that it leased. Seritage’s other tenants paid an average of $13.18.

Leave A Comment