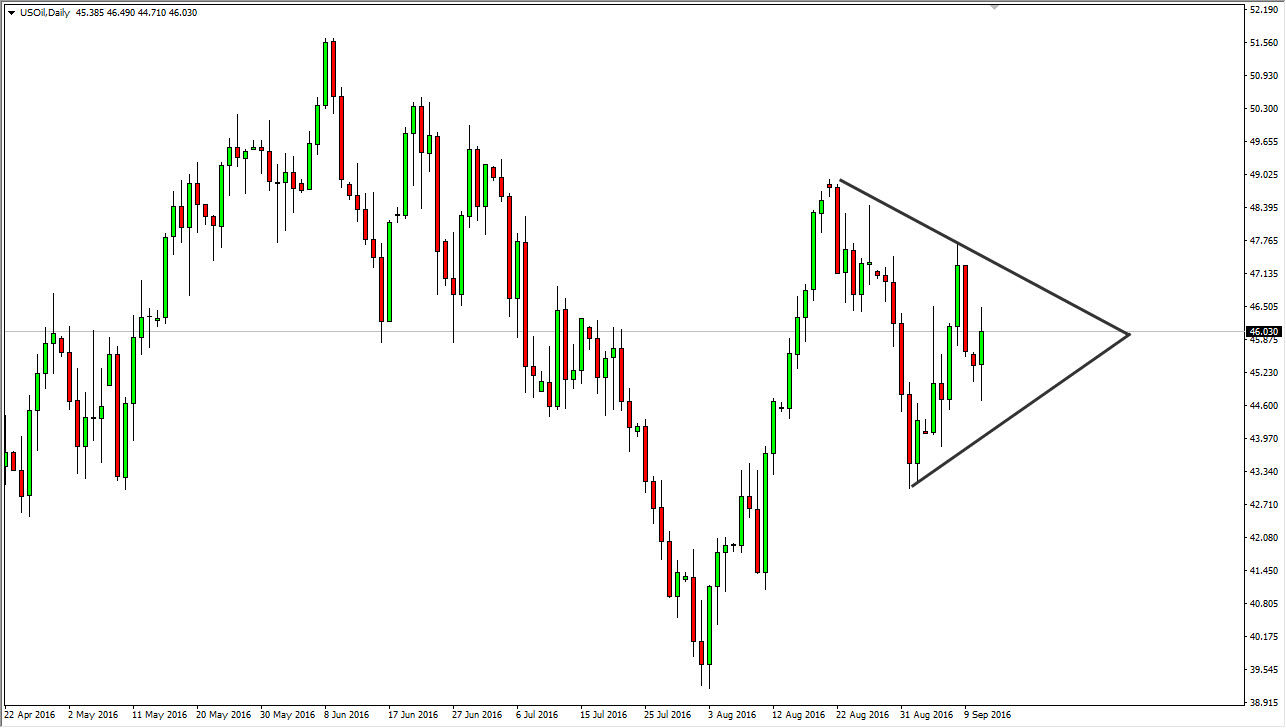

WTI Crude Oil

The WTI Crude Oil market had a very volatile session during the day on Monday, initially falling down to the $44.50 region. Ultimately, this is a market that seems to be very volatile, and I believe that we are trying to tighten up the range. Given enough time, will have to make some type of impulsive move, but at this point in time I simply do not believe that the market is ready to do so. After all, we are starting to worry about demand and of course the value of the US dollar, acetyl bankers continue to kick around interest-rate expectations. With that being the case, the market will more than likely continue very choppy short-term movements. With this in mind, I’m looking for a short-term exhaustive candle that I can sell for a quick trade.

Natural Gas

Natural gas markets rose during the course of the session on Monday, breaking well above the $2.80 level. This market tested the $2.90 level above, but then watched the sellers step back into the marketplace as there is a massive amount of resistance extending all the way up to the $3 handle. I believe that given enough time, we will have sellers reenter this market and push the value of natural gas down. Even if we were to break out to the upside ultimately, we still will have plenty of pullbacks from time to time as there should be a lot of volatility. If we do break above the $3 handle however, that would be an extraordinarily bullish sign and should have the buyers stepping in, taking advantage of a serious breakout. At this point in time though, I don’t think it can happen easily so therefore I am looking to play this market to the downside as soon as I get some signs of weakness or bearish pressure.

Leave A Comment