Many are harking back to the Reagan era for guidance on how to implement the pro-growth policies advocated by President Trump and Congress. When Ronald Reagan took over the leadership of the United States in 1981, he inherited an economy that had endured nearly a decade of stagnate growth combined with accelerating consumer prices.

Tax cuts lay at the heart of the Reagan revolution. Reagan believed that high taxes threatened individual freedom, suppressed overall economic growth, and encouraged wasteful government spending. Thus tax laws of 1981 are the single most important piece of legislation to emerge from Reagan’s first term. That sweeping tax cut slashed federal income tax rates, for taxpayers in every income bracket, by 25% over a three-year period. However, slashing taxes came at high price.

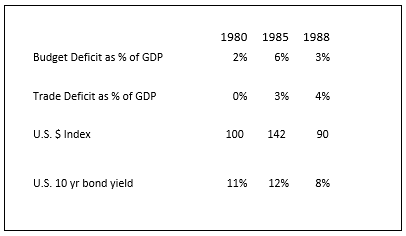

Reagan’s failure was his inability to restrain government spending. Reagan ran for office in 1980 as a harsh critic of “tax and spend” liberalism, vowing as president to shrink the size of the government by slashing federal spending. Once in office, however, Reagan found it impossible to deliver on his promises. Simply, the Reagan administration blew up the federal deficit to 6 per cent of GDP in 1985 from just 2 per cent in 1980. (See accompanying table). It was not until the first term of President Clinton that a balanced budget was restored.

This tripling of the national budget deficit was highly stimulating, ironically, in the sense of the Keynesian model whereby government primes the pump of the economy. But the surge in the deficit had unintended consequences.

First, while still fighting the high inflation created in the 1970s, the Fed continued with its tight-fisted monetary policy. Long term rates remained above 10 per cent for much of the decade and really did not start to make their long decent until the first half of the 1990s. The cost of debt financing was part of the problem of containing the deficit. The United States had to fight internal inflationary pressures and at the same attract foreign savings to fund the deficit.

Leave A Comment