Yesterday was an encouraging day for bulls and anyone else long US equities as the S&P 500, Nasdaq, and Dow all hit new all-time highs for the first time since July.

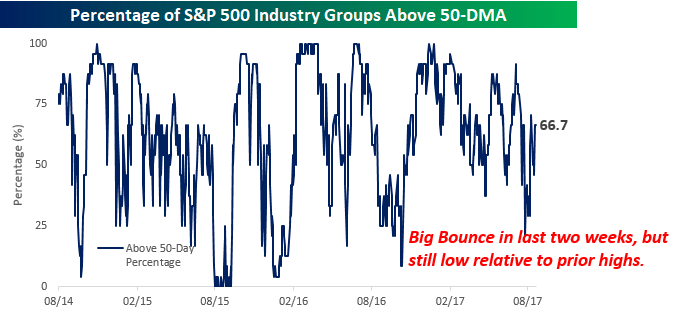

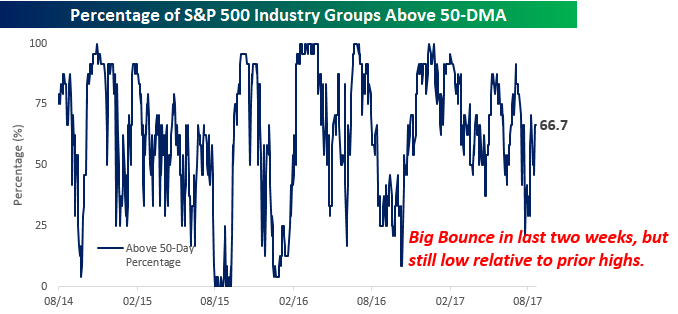

It’s great to see the market trading at new highs, but as we have been highlighting for some time now, some measures of breadth have been relatively weak for the last few weeks now. A case in point is the percentage of S&P 500 Industry Groups trading above their 50-day moving averages (DMA).

As shown in the chart below, while we have seen a big bounce from late August when less than a third were above their 50-DMAs, at yesterday’s close just two-thirds of Industry Groups were above their 50-DMAs.

Relative to other times this year when the S&P 500 hit a new high, this reading is on the low side.

Leave A Comment