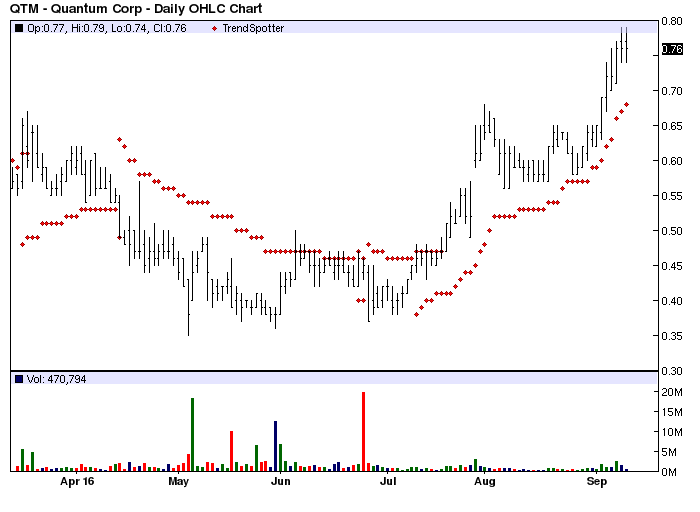

The Chart of the Day belongs to Quantum (NYSE:QTM). I found the data storage device stock by using Barchart to sort today New High list first for the most frequent number of new highs in the last month, then again for technical buy signals of 80% or more. Since the Trend spotter signaled a buy on 7/12 the stock gained 65.22%.

Quantum is a leading expert in scale-out storage, archive and data protection, providing solutions for capturing, sharing and preserving digital assets over the entire data lifecycle. From small businesses to major enterprises, more than 100,000 customers have trusted Quantum to address their most demanding data workflow challenges. With Quantum, customers can be certain they have the end-to-end storage foundation to maximize the value of their data by making it accessible whenever and wherever needed, retaining it indefinitely and reducing total cost and complexity.

The status of Barchart’s Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

Fundamental factors:

Leave A Comment