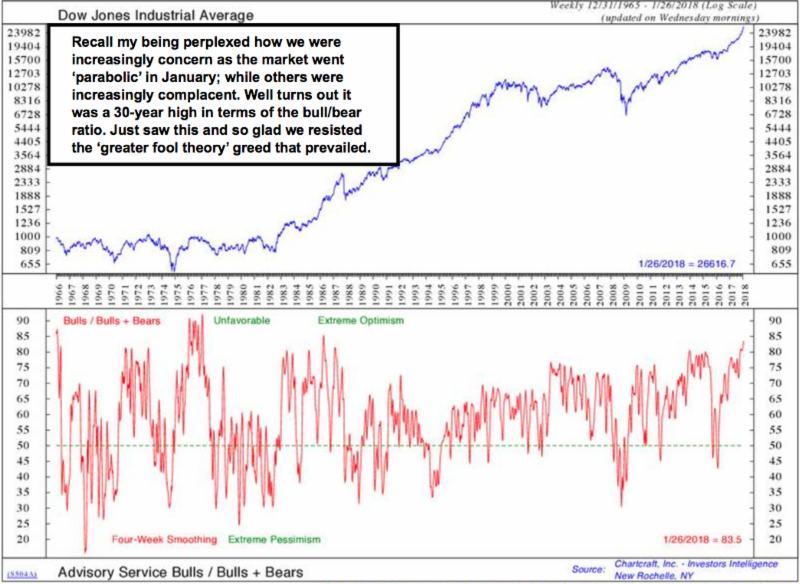

Risky business of washing out and rebounding from a ‘flash crash’ I’d forecast for early February, quickly brought out not just sober reflections by some pundits and analysts; but brazenly risque assumptions cajoling investors to ‘buy that dip’; what an opportunity. Hardly; it was textbook. It is now going to lower lows; a bounce will fail; and this is clearly not over.

In fact it was so textbook perfect (the drop to the 200-day MAL and rally to the 50-day MAL) troubled me. Because it was too formulaic but also it was occurring as 10-year rates were firming again to levels preceding a concern that preceded the market’s drive down in the first place. Now of course a new angle-of-attack trendline exists to the downside, with very solidly-defined A-B-C technical aspects to the S&P’s ongoing slide.

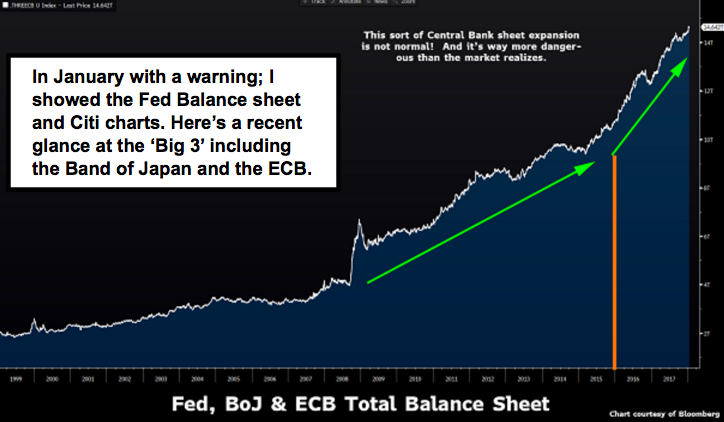

For sure the option-writing ‘short-vol’ backdrop was a catalyst; but so too were interest rates; and too many presumed that NY Fed’s Bill Dudley in a sense emboldened the Bulls. My view was the opposite; that he surely calmed markets by virtue of saying there was nothing systemic requiring Fed intervention; but that also meant ‘let the hunt for value’ continue; it’s normal market behavior. I agree; hence the call for more decline.

Thursday’s ideal down-up-down pattern ideal was definitely contingent it seemed on another Treasury Auction, which if it went poorly would tend to frustrate the Bulls too. Our view was that the market’s rebound had a period of testing ahead almost regardless; but that higher rates certainly would speed up the process; in what remains fast market conditions.

In simple parlance, we foresaw all of this particularly clearly, as there was in our opinion along the way, a protracted forecast Trump rally over a year long overall, which (while requiring tax reform to be passed) was all along ‘anticipating and thus discounting’ the actual economic revival.

Leave A Comment