Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,180, and profit target at 2,020, S&P 500 index).

Our intraday outlook is bearish, and our short-term outlook is bearish. Our medium-term outlook is neutral, following S&P 500 index breakout above last year’s all-time high:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): neutral

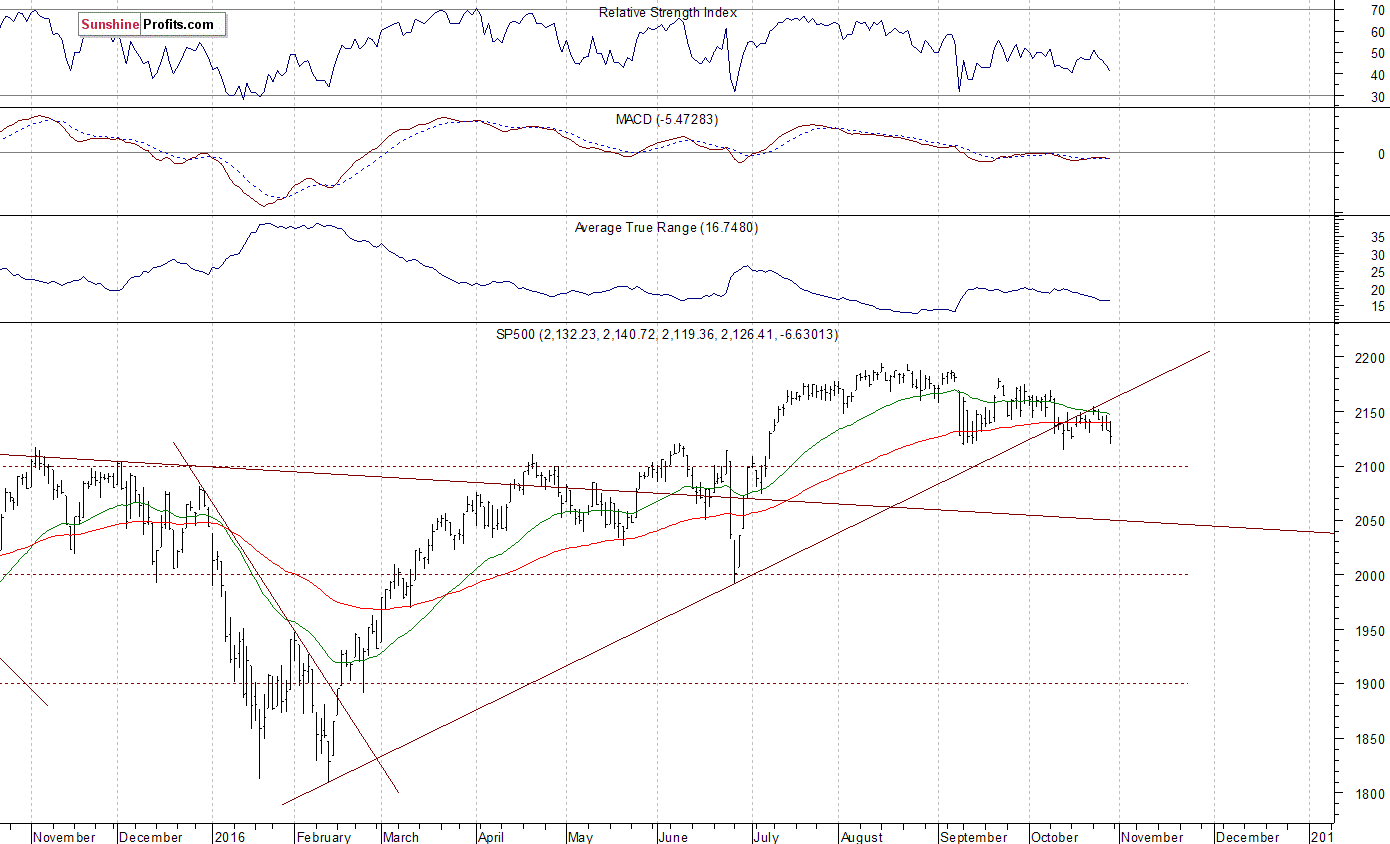

The U.S. stock market indexes lost between 0.1% and 0.6% on Friday, as investors reacted to economic data, quarterly earnings releases, among others. The S&P 500 index continues to trade below its resistance level of 2,150. There has been no clear short-term direction so far. The next resistance level is at 2,170-2,180, marked by some previous local highs. On the other hand, level of support is at 2,130, and the next support level is at 2,115-2,120, marked by previous local lows. The market continues to trade along medium-term upward trend line, as the daily chart shows:

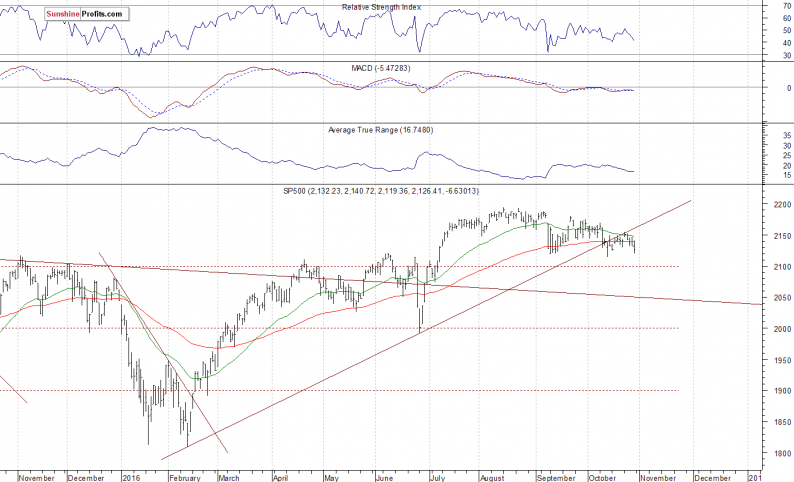

Expectations before the opening of today’s trading session are positive, with index futures currently up 0.1-0.3%. The European stock market indexes have lost 0.4-0.8% so far. Investors will now wait for some economic data announcements: Personal Income, Personal Spending, Core PCE Price Index at 8:30 a.m., Chicago PMI number at 10:00 a.m. The S&P 500 futures contract trades within an intraday consolidation, following a rebound off support level at around 2,100-2,110. The nearest important level of resistance remains at 2,140-2,150, marked by some previous local highs. There have been no confirmed positive signals so far.

The technology Nasdaq 100 futures contract follows a similar path, as it currently trades within an intraday consolidation, after rebounding off support level at 4,780-4,800. The nearest important resistance level is at 4,820-4,850, marked by previous support level, as we can see on the 15-minute chart:

Leave A Comment