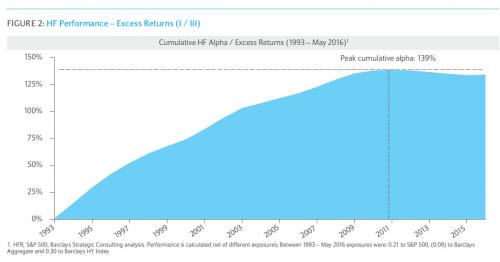

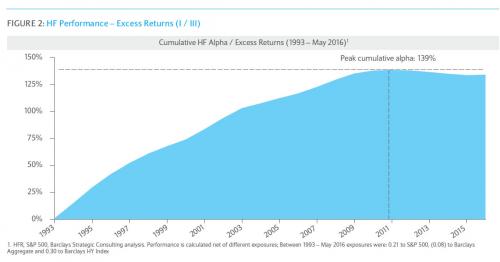

After nearly a decade of central planning by global monetary authorities, the hedge fund industry has found itself unable to generate any alpha since 2011. As Barclays recently calculated, the average monthly alpha has declined to -0.07% (annualized ~0.8%) from 2011 to May 2016 compared to an average of +0.48% (-5.9% annualized) for the entire period analysed (1993 to May 2016).

This has resulted in not only formerly respected hedge fund managers like Bill Ackman (as well as countless more) being forced to revise the traditional 2 and 20 fee structure to retain fleeing clients, but also the biggest outflow from active managed funds on record, as inflows into passive, ETF-based asset managers continue unabated.

This unprecedented shift in capital away from active managers and toward passive strategies has resulted in not only a chilling effect on the hedge fund industry, culminating with the fewest hedge fund launches since 2000, and massive redemptions, creating a feedback loop which assures even lower returns in the future and even more pain for the “2 and 20” crowd…

… but also concerns about a market in which “passive”, robotic, algo-driven decision makers are the marginal buyers and sellers of securities.

And while it is the case that so far, the market has been spared an observation of how a largely passive investing crowd would respond during a downturn (and more importantly what happens to market liquidity), the time is drawing nearer with every passing day, and certainly as central bankers collectively try to prop up global yield curves.

So what are the implications from this shift toward passive investing?

Conveniently, that is the topic of the latest Flows and Liquidity piece from JPM’s Nikolaos Panagirtzoglou, in which he makes some interesting and troubling observations, of which three are key:

Leave A Comment