Twitter (TWTR) shares have stormed out of the gate, following today’s Q4 earnings which smashed expectations, with revenue of $731.6 million, up 2% Y/Y, beating the highest estimate ($709MM) and certainly the consensus of $686.4MM, while EPS of 19 cents was also above the 14 cent estimate.

Twitter was quick to point out its reversal in revenue noting that “total revenue in Q4 was $732 million, reflecting year-over-year growth of 2%, as compared to a decline of 4% in Q3 2017, a decline of 5% in Q2 2017, and a decline of 8% in Q1 2017.”

Commenting on the result, Twitter said that “Q4 was a strong finish to the year with total revenue increasing 2% year-over-year, and owned-and-operated (O&O) advertising revenue increasing 7% year-over-year, reflecting better-than-expected growth across all major products and geographies.”

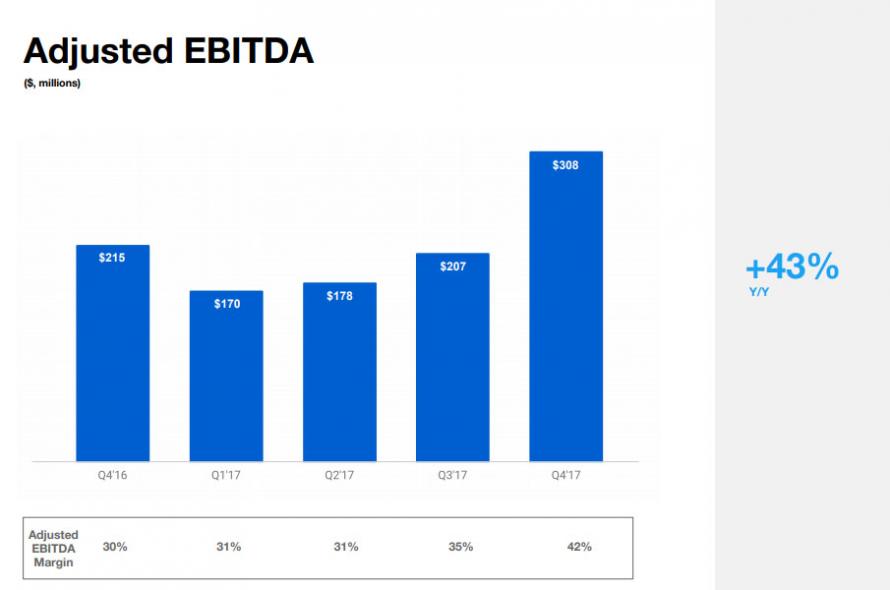

Also of note, EBITDA of $308.2MM was over 20% higher than the $241.6MM expected.

The company’s outlook was also impressive, with Twitter predicting that in Q1, Adjusted EBITDA would be between $185 million and $205 million, vs est of $188.3MM, on adjusted EBITDA margin to be between 33% and 34%. For the full year, Twitter expects capital expenditures to be between $375 million and $450 million.

And yet, not all was well, for one the number of MAUs failed to grow sequentially (up 4% Y/Y), and at 330MM, missed expectations of 333MM. More ominous, and an echo of recent events at Facebook, Twitter’s US MAUs declined by 1 million.

Also a concern: US ad revenue tumbled by 10% to $342MM from $382MM a year earlier.

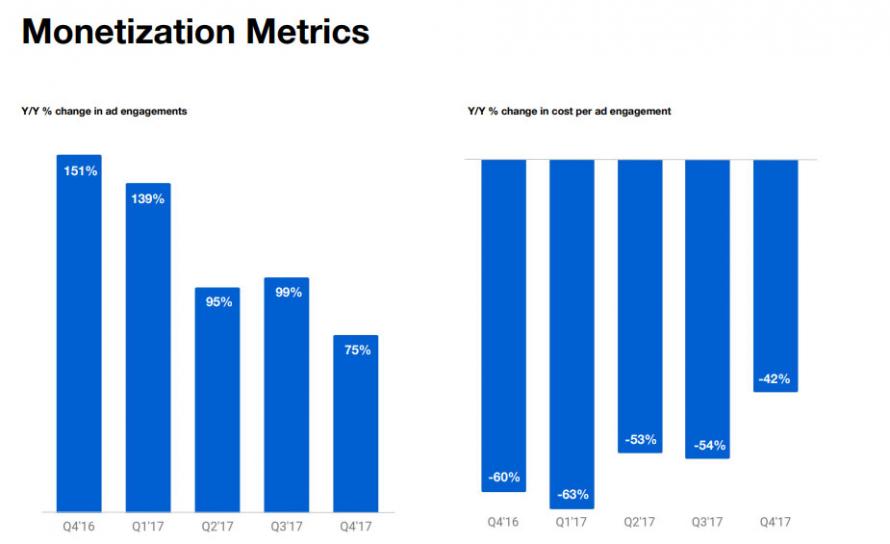

Not helping is the sharp drop in ad engagements, which at 75% were down by more than half from the year ago period.

This is how the company explained the drop in US revenue:

Total US revenue was $406 million, down 8% year-over-year. Total international revenue was $326 million, increasing 17% year-over-year. We saw continued regional strength in Asia Pacific and improvement in some EMEA markets. Japan grew 34% year-over-year and contributed $106 million, or 15% of total revenue.

Leave A Comment