Gladstone Land Corporation (LAND) is a Real Estate Investment Trust. REITs are popular investments because they typically pay high dividend yields. LAND is one of 171 REITs in the Sure Dividend database.

LAND has an attractive dividend yield of 4.2%, which is roughly double the average yield of the S&P 500 Index. And, LAND pays its dividends each month, rather than each quarter. Sure Dividend has compiled a list of stocks that pay monthly dividends.

LAND is a unique REIT. Whereas most REITs own physical buildings across various industries like retail or healthcare, LAND owns farmland, as well as vineyards.

This article will discuss LAND and why it could be a valuable stock for diversification and dividend income.

Business Overview

LAND invests in farmland and farm-related properties in the U.S. Its property portfolio currently includes 72 farms, encompassing over 61,000 acres in 9 different U.S. states. The reported value of the portfolio is approximately $531 million.

LAND typically purchases properties and leases them back to farmers, known as sale-leaseback transactions. Many of its leases are triple-net, meaning LAND receives a steady stream of rental income, while the tenants are also responsible for real estate taxes, insurance, and maintenance expenses.

Some of LAND’s leases also include a revenue-sharing component, based on the crops harvested on the farms.

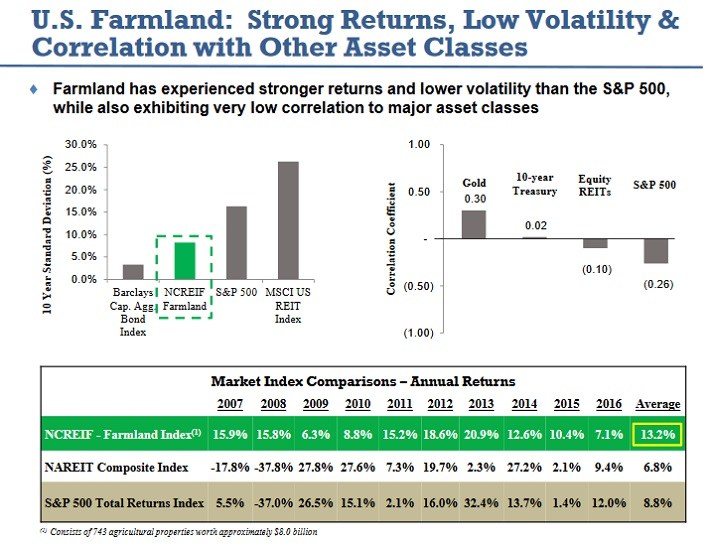

U.S. farmland has proven to be a very strong investment over many years, characterized by stronger returns and lower volatility than other real estate investments, and the S&P 500 Index.

Source: June 2017 Investor Presentation, page 6

LAND’s operating strategy is to own farmland in three categories: produce, nuts, and grains. According to the company, produce and permanent crops are more profitable than commodity crops, because they yield higher rental incomes, exhibit less price volatility, and have lower storage costs.

Leave A Comment