Gold looks technically superb, and the fundamentals look even better.

Inflation is rising in China and the West, the dollar looks shaky against key fiat competitors, and a reversal in American money velocity is imminent.

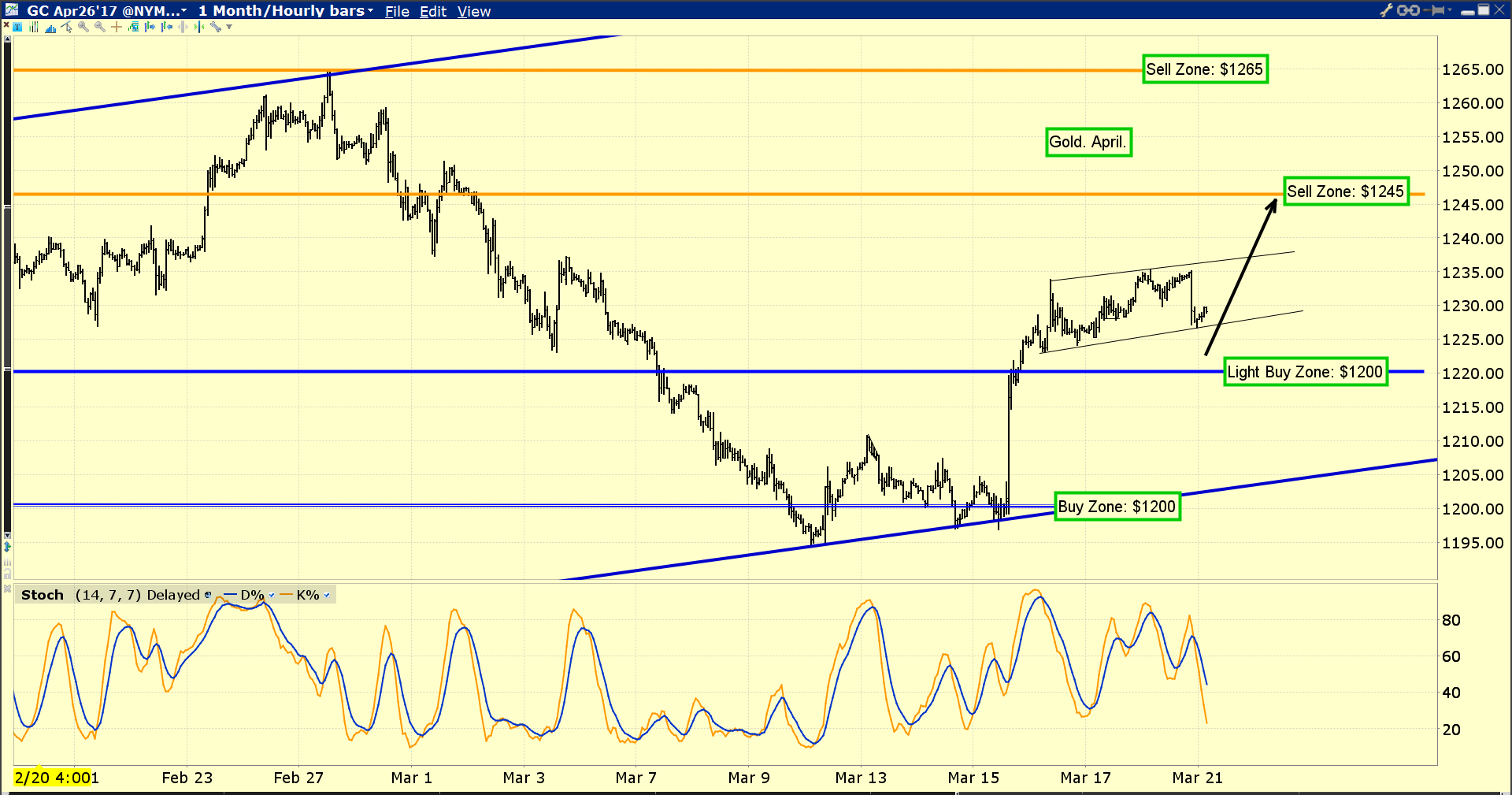

Double-click to enlarge this hourly bars gold chart.

The next COMEX options expiry day is March 28. Gold has a rough general tendency to trade a bit sluggishly ahead of option expiry days, and that appears to be happening now.

Double-click to enlarge this daily bars chart for gold.

I call this technical picture the “uptrend of champions”.

For a closer look at the price action within the uptrend channel.

Double-click to enlarge.

There’s an inverse H&S bottom pattern in play on this four-hour bars chart.

For gold, all my technical lights are green, and once this option expiry day is out of the way, the “Queen of Assets” should make a beeline towards the $1265 area highs!

Double-click to enlarge.

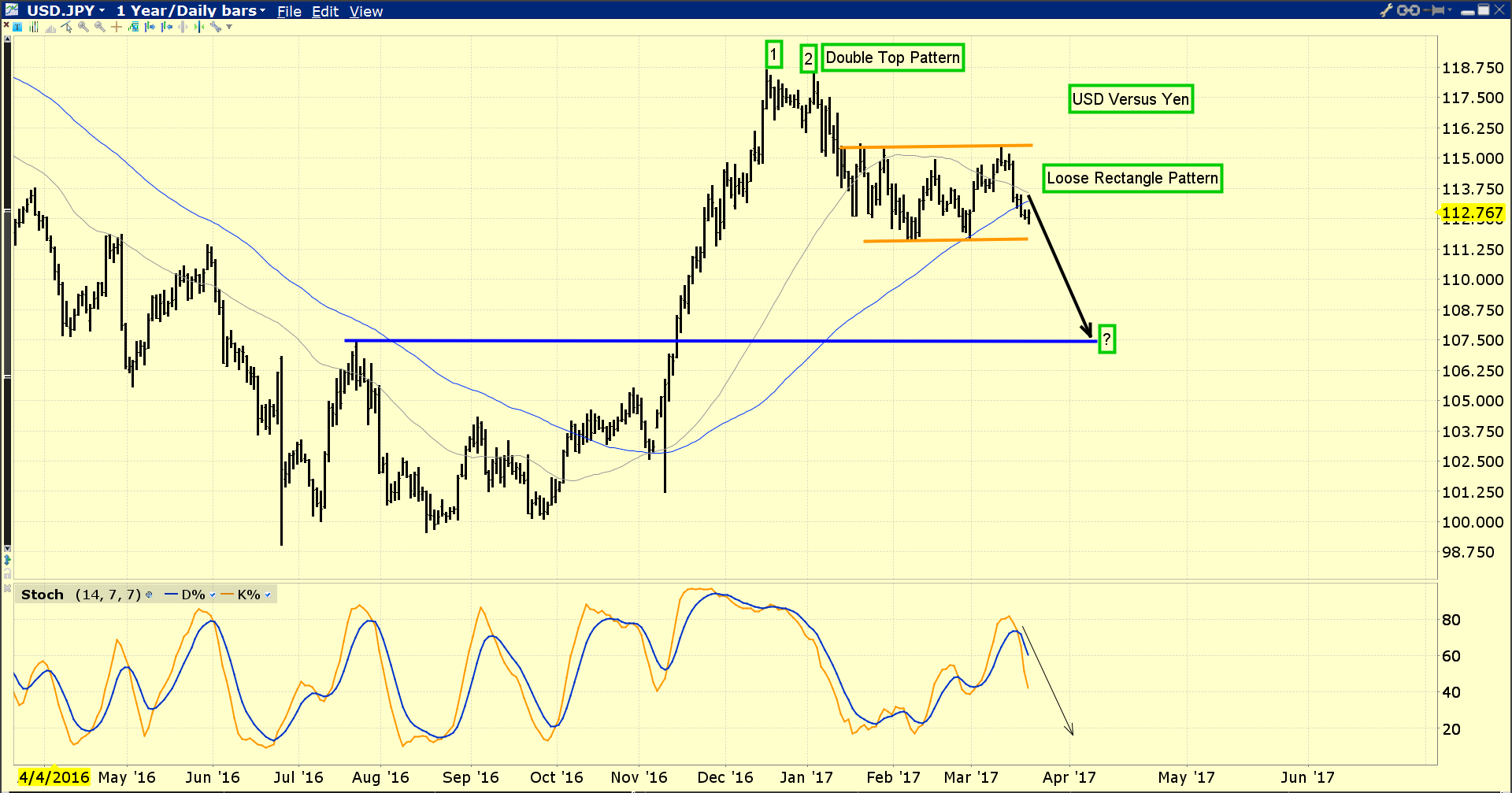

Against the yen, the dollar looks horrible. Note the action of the 50DMA and 100DMA moving averages. A sell signal seems imminent. That’s good news for higher gold price enthusiasts.

Double-click to enlarge.

Against the Swiss franc, the dollar looks like a train wreck. The moving averages are flashing a sell signal, and that comes after a meltdown from an H&S top pattern.

Double-click to enlarge.

The euro is rallying strongly against the dollar, and it looks set to stage an upside breakout from both a triangle and inverse H&S bottom pattern.

In regards to global stock markets. It’s clear that for their stock market action, the Western gold community should be selling America at a profit and buying Asia.

American bank stocks are the one exceptions to that “rule”; banks will prosper as rates rise. They will do a lot of lending to Europe and to Asia, because that’s where the higher growth is going to take place.

Leave A Comment