Amid reports of a slowing ramp up in Model 3 production, and the company’s own warning last quarter that manufacturing challenges during a production ramp such as this “makes it difficult to predict exactly how long it will take for all bottlenecks to be cleared or when new ones will appear”, investors were looking ahead with trepidation to today’s Tesla earnings report, especially with Elon Musk’s attention recently seemingly focused on outer space than dominating the terrestrial auto sector, despite the stock rising in recent days on hopes that the company will be able to get to its new, reduced target of 5,000 cars per week.

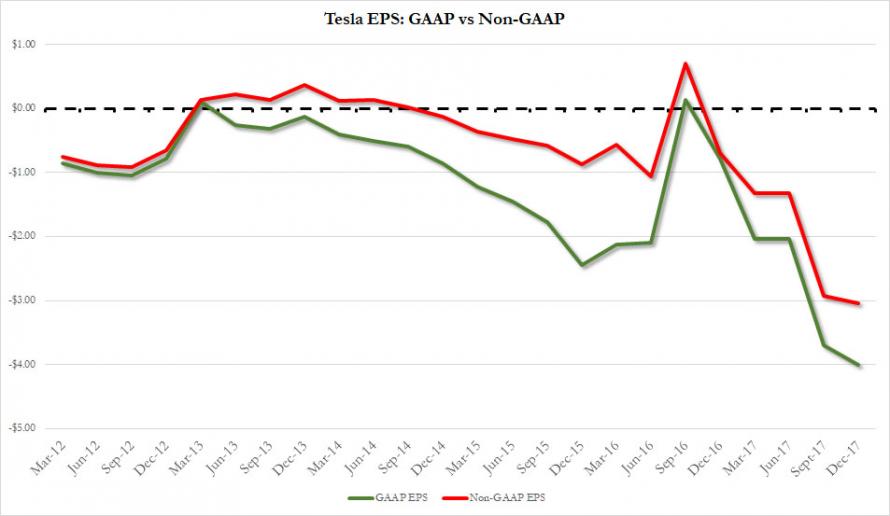

Well, this time around, there was no bad news, when Tesla reported a Q4 loss of $771 million, or an adjusted EPS of ($3.04), better than the $3.20 expected if more than 4 times greater than the $0.69 loss one year ago.

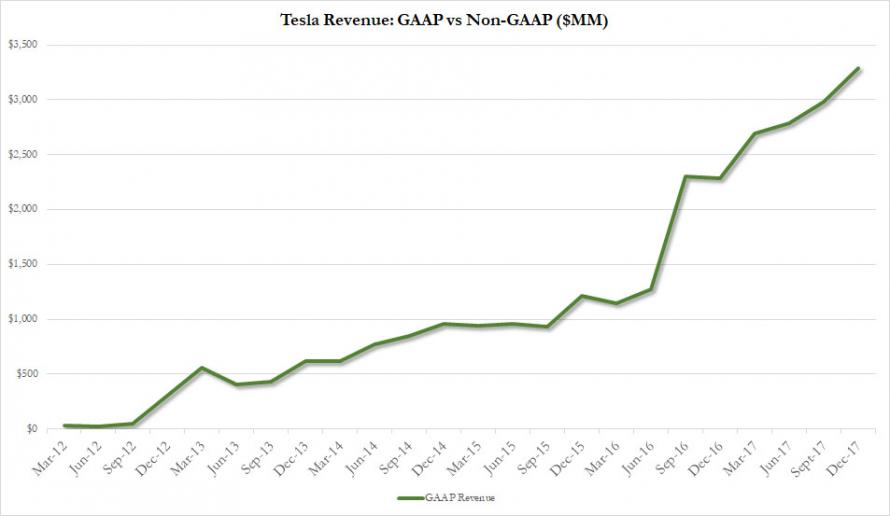

There was more good news hiding in Tesla’s top line: the company reported revenue of $3.29bn, just above the $3.28 billion expected, which however was offset by the decline in gross margin which was 13.8%, far below the 14.8% estimate.

But the biggest surprise was in Tesla’s cash burn which unexpectedly plunged from a record $1.4 billion in Q3 to just $276.8 million in Q4, far below the $900 million expected. Altogether, Tesla burned $3.475 billion in cash in 2017. Looking ahead, Tesla warned that “capital expenditures in 2018 are projected to be slightly more than 2017.”

Then we get to the all-important auto deliveries: here we learn that in Q4, Tesla delivered 1,542 Model 3 cars to eagerly waiting customers, which however as Bloomberg notes, means that some 400,000 are still waiting. But most importantly, and in light with the recently reduced guidance, Tesla still sees Model 3 weekly production target of 2,500 by the end of Q1 and 5,000 by the end of Q2, and sees overall 2018 revenue growth significantly exceeding 2017, which of course was to be expected.

Leave A Comment