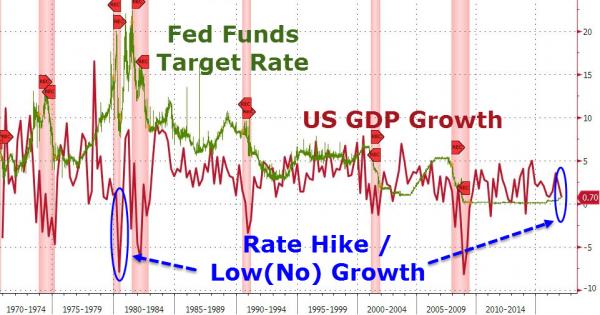

In the week when it was confirmed that Q1 was the weakest economic growth for a rate hike period since 1980…

Bond bears have never puked so much in such a short period of time as the $25 billion plus short-cover in 10Y Treasury bond futures in the last week.

In fact the stunning swing in sentiment in the last 8 weeks (with almost $62 billion in 10Y Treasury shorts dumped) is shocking to see, smashing Speculative Positioning from its shortest ever to its longest in over 9 years…

And perhaps more notably, the aggregate Treasury futures complex has shifted to a net long speculative position for the first time since July 2016…

Note that Eurodollar futures shorts (rate hike bets) did increase modestly this last week (after dropping the week before).

Leave A Comment