When a country’s central bank reduces its interests rates below zero (i.e., “goes negative”), the action should boost the relative appeal of stock assets. That is the theory. Unfortunately, recent policy initiatives by the European Central Bank (ECB) and the Bank of Japan (BOJ) have failed to inspire their respective stock markets.

The ECB first began fooling around with negative interest rate policy in June of 2014 by lowering its overnight deposit rate to -0.1.% It went to -0.2% in September of 2014; it went even lower (-0.3%) by December of 2015. Did these rate manipulating endeavors benefit European equities or hurt them? The EuroStoxx 600 Index moved lower shortly after each of the interventions and it currently trades at a lower value since the inception of negative rates.

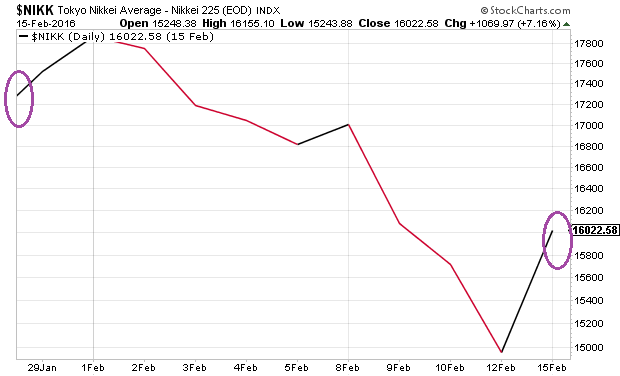

Meanwhile, the Bank of Japan (BOJ) became the second major player to announce plans to charge financial institutions (-0.1%) for the privilege of depositing money. Since the announcement on January 29, 2016, the Nikkei 225 has shed 7.5% of its value. The price depreciation even includes a monster 7% snap-back rally – a price surge that came on speculation that the BOJ will enact more “stimulus” due to persistent recessionary pressures.

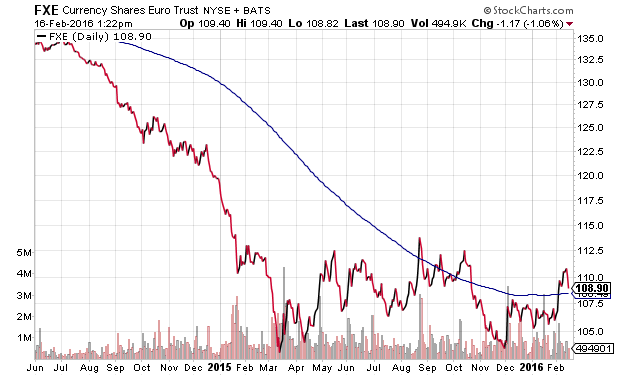

Naturally, front-loading an enormous rally in stock and real estate prices to create a wealth effect is not the sole aim of a country’s central bank. Academic policy leaders believe that sub-zero rate policy strengthens a region’s or nation’s export competitiveness by weakening a corresponding currency. Take a peek at the falling euro via CurrencyShares Euro Trust (FXE) since June of 2014.

On the flip side, European exporters haven’t exactly been lighting the world on fire since its currency cratered. Trade volumes have been largely flat. Whatever exporting advantage might have been reaped from a a weaker euro-dollar was nullified by anemic demand around the globe. It seems there is more to winning the global trade game than engaging in currency wars.

Leave A Comment