So let’s get this straight. Russia and OPEC ‘agree’ to consider (not actually act upon) “freezing” production levels (at current record high levels) and the market plunges amid disappointment over no cuts. And today WTI spikes and erases all those losses as Iran supports the “freeze” plan, but will not cut its own production plans…

Iran said on Wednesday it would resist any plan to restrain its oil output as fellow OPEC ministers tried to persuade the country to join the first global oil pact in 15 years.

Talks in Tehran between Iranian oil minister Bijan Zanganeh and his counterparts from Iraq, Qatar and Venezuela lasted for nearly three hours. Visiting ministers left without making comment.

“Asking Iran to freeze its oil production level is illogical … when Iran was under sanctions, some countries raised their output and they caused the drop in oil prices.” Iran’s OPEC envoy, Mehdi Asali, was quoted as saying by the Shargh daily newspaper on Wednesday.

“How can they expect Iran to cooperate now and pay the price?” he said. “We have repeatedly said that Iran will increase its crude output until reaching the pre-sanctions production level.”

And so – Crude rallies??!!

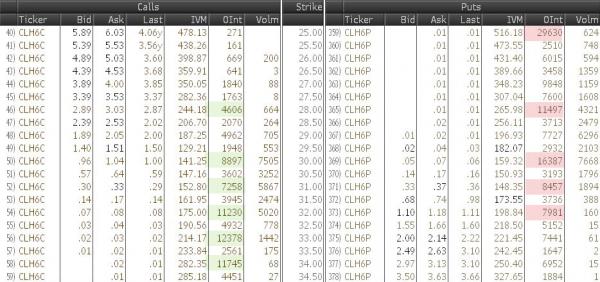

What is really diving all this craziness is that it is OPEX in Crude futures today and there are major pins around $31, $30, and $28.

Leave A Comment