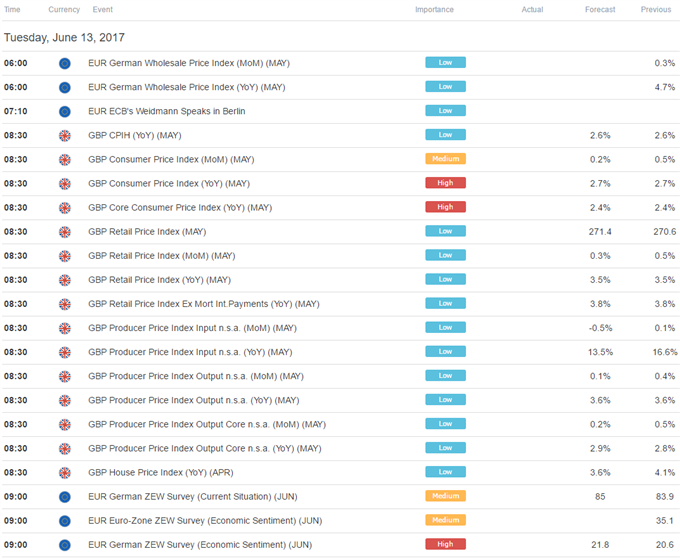

UK CPI data headlines the economic calendar in European trading hours. The headline on-year inflation rate is expected to print at 2.7 percent in May, unchanged from the prior month. Anything short of significantly disappointing outcome seems unlikely to have a lasting impact on the British Pound.

Political uncertainty after last week’s snap election seems likely to mean that the status quo is the best-case scenario for near-term BOE monetary policy. Softer inflation following four months of deteriorating news-flow against this backdrop may stoke stimulus expansion bets, sending the UK unit lower.

Germany’s ZEW survey of investor confidence is also on tap, with consensus forecasts pointing to another uptick. An upbeat result seems unlikely to mean much for the Euro considering its limited implications for ECB strategy. Central bank officials have forcefully argued against tightening in the near term.

Later in the day, May’s US PPI data unlikely to make waves as traders look ahead to Wednesday’s FOMC policy announcement. Politics may dominate the spotlight once again however as Attorney General Jeff Sessions testifies before the Senate Intelligence Committee.

Mr Sessions’ appearance follows ousted FBI director James Comey suggesting he may be implicated in some manner of impropriety vis-à-vis contact between the Trump campaign and Russian officials. He may also speak on Comey’s alleged request not to be left alone with the President.

The US Dollar may turn lower if traders interpret Mr Sessions’ testimony as deepening US political uncertainty and opening the door for market turmoil that sidelines the Fed in the second half of the year. An immediate risk-off reaction is also likely to boost the Japanese Yen.

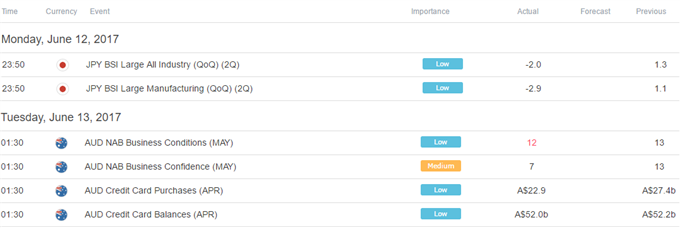

Asia Session

European Session

** All times listed in GMT.

Leave A Comment