Talking Points:

Fundamental Forecast for NZD: Neutral

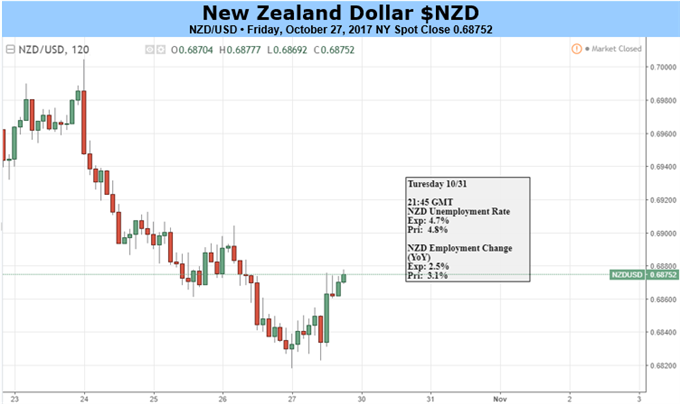

We remain neutral on NZD/USD for the time being after recent heavy losses have forced the pair back to levels last seen in May this year. The Kiwi rally from 0.6810 up to 0.7558 on July 27 has all been given back, leaving the pair open to a short-term retracement before a further move lower.

NZD/USD has dropped sharply since the announcement of a new government whose policies include a shake-up of the Reserve Bank Act which would give the central bank a more prominent in controlling the foreign exchange rate, and a plan to increase the minimum wage. Recent New Zealand trade data disappointed with imports rising more than expected in September while exports missed market expectations.

On the other side of the pair, the US dollar continued to pick-up, driven in part by higher US Treasury yields and news that the US House of Representatives had passed a budget blueprint for 2018, opening the door for US President Trump’s much heralded tax reforms.

A rebound for NZD/USD is likely to find resistance at the 0.6993 Fibonacci retracement level ahead of the cluster of previous lows around 0.7050. On the downside the May 2016 low of 0.6675 comes into play, followed by a Fibonacci extension low of 0.6616.

Chart: NZD/USD Daily Time Frame (March – October 27, 2017)

Leave A Comment