The market had a variety of economic updates today: the third estimate of Q3 GDP, some real estate reports and the latest Richmond Fed manufacturing. But the key driver of today’s advance was probably the rise in WTI February Futures, up 1.84% and higher than Brent Futures for the first time since August 2010. The S&P 500 rose steadily through the day to its 1.07% intraday high in the final hour. It closed with a trimmed gain of 0.88%. Volume, however, was on the light side.

The yield on the 10-year note closed at 2.24%, up 4 bps from yesterday’s close.

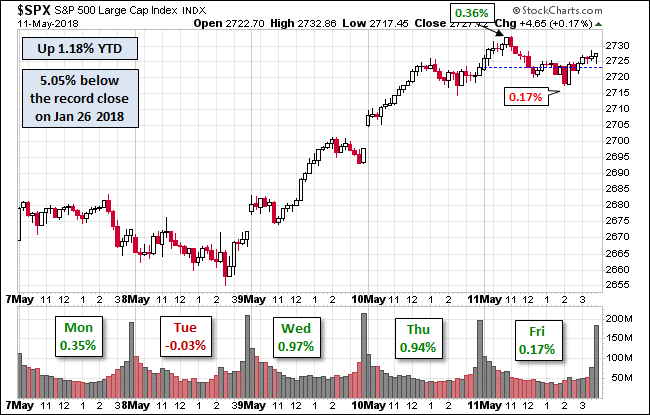

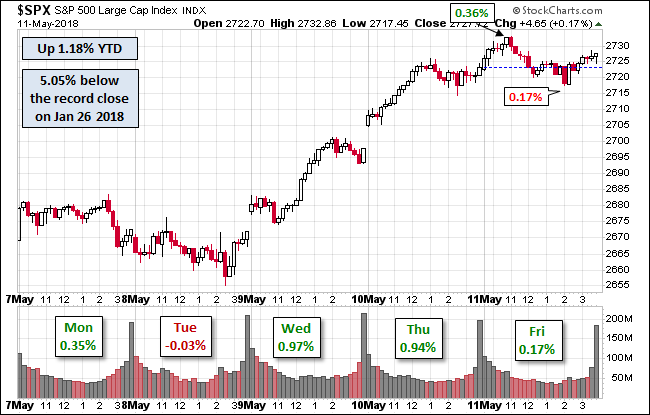

Here is a snapshot of past five sessions.

Here is a daily chart of the index. Volume on today’s advance was 18% below its 50-day moving average.

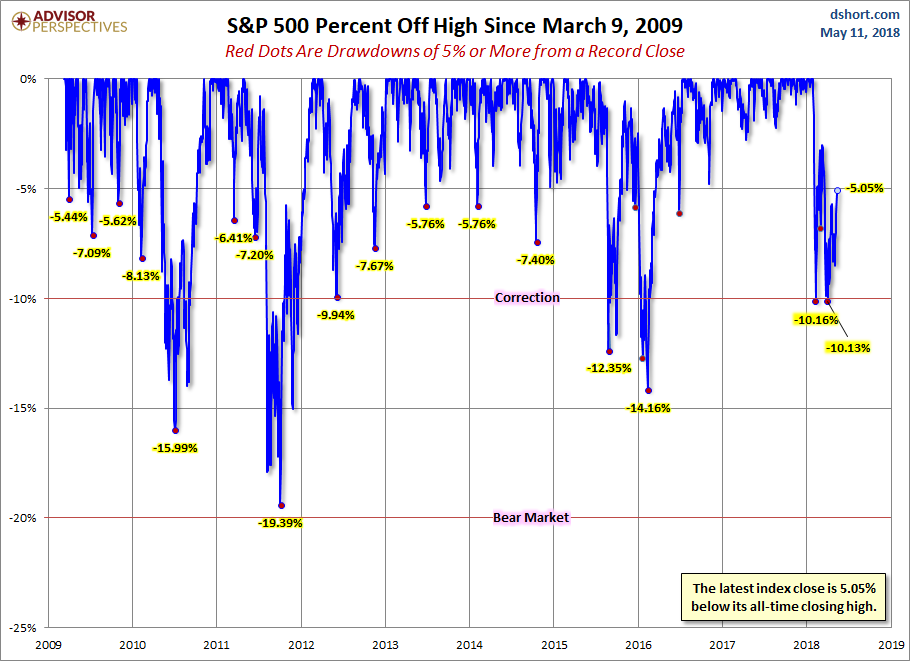

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

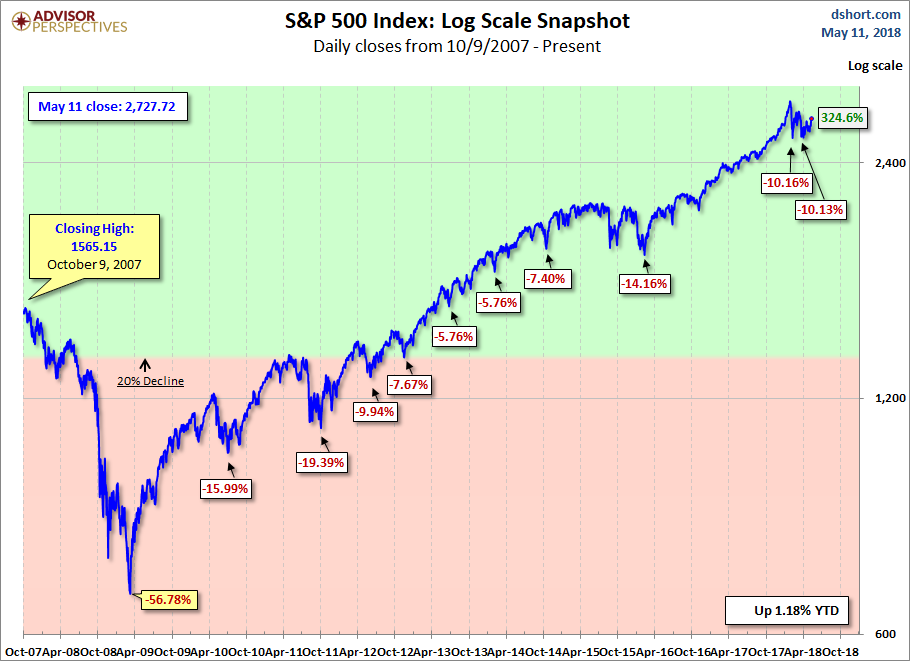

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

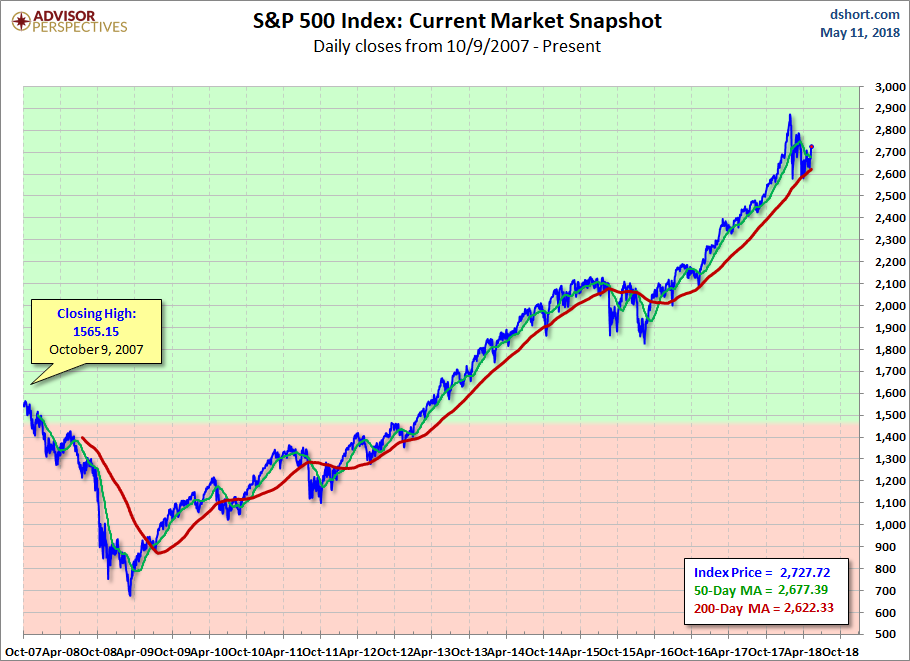

Here is the same chart with the 50- and 200-day moving averages. The 50 crossed below the 200 on August 28th.

Leave A Comment