Tuesday, February 16

Wednesday, February 17

Thursday, February 18

What are you expecting for companies reporting this week? Get your estimates in now!

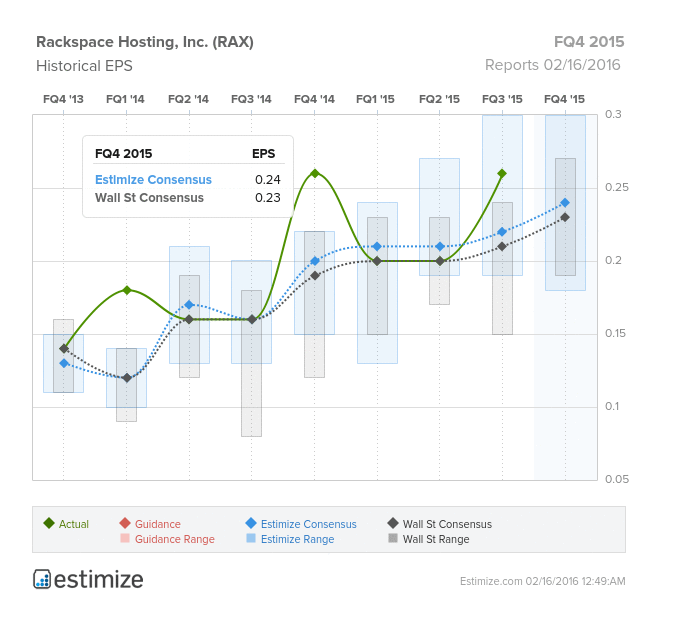

RAX (RAX)

Information Technology – Internet Software & Services | Reports February 16, after the close.

The Estimize community calls for EPS of $0.24, just one penny higher than the Wall Street consensus. Revenue estimates from Estimize are slightly more bullish as well, at $522.7M vs. the Street’s $521.7M and guidance of $485.4M.

What to Watch: Despite how fast cloud computing is growing, not all players in the industry are winners. That’s something Rackspace needs to consider as shares of the company have fallen a resounding 65% in the past the past 12 months. The cloud computing specialist has struggled to maintain growth while heavy hitters like Google, Microsoft and Amazon take the industry by storm. Just this year, Amazon and Microsoft cut prices of their flagship cloud products, partly explaining the 30.4% drop in Rackspace’s stock year-to-date. To avoid getting squeezed out by the competition, Rackspace has focused on investments in its services. The company recently launched “fanatical support”, an around the clock managed support service dedicated to serving Amazon Web Services and Azure customers. Rackspace is also targeting Adobe users, offering a managed cloud service devoted to marketing leaders and technology teams. The service aims to optimize solutions surrounding websites and mobile apps on Adobe Experience Manager. In the short-term, these investments into managed solutions as well as additional data centers and servers are expected to put pressure on Rackspace’s bottom-line. Read more about RAX!

Fossil (FOSL)

Consumer Discretionary – Textiles, Apparel & Luxury Goods | Reports February 16, after the close.

The Estimize community calls for EPS of $1.36, 7 cents higher than Wall Street while revenue estimates of $924.9M vs. $919.25M, both below company guidance.

Leave A Comment