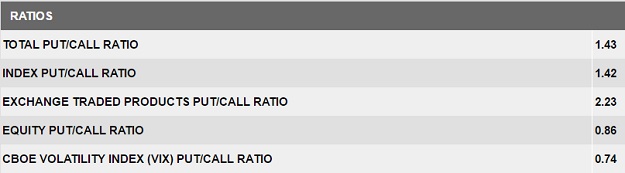

Investors nervous about the possibility that a Trump election victory will lead to a market correction are taking precautions. A Reuters equity market poll last month showed a majority of forecasters predicted that U.S. stocks would perform better under a Clinton presidency than a Trump administration. The perception of a sure Clinton victory has been upended after FBI Director James Comey announced the agency is reviewing a newly found batch of emails related to the former Secretary of State. The market responded with six consecutive days of losses in the S&P 500. As evidenced in the table below, investors are investing heavily in put option contracts for protection if in fact Trump wins and the market does crash.

A tool to help confirm the overall market trend is the Bullish Percent Index (BPI). The Bullish Index is a popular market “breadth” indicator used to gauge the internal strength/weakness of the market. It is the number of stocks in an index (or sector) that have point & figure buy signals relative to the total number of stocks that comprise the index (or sector). So essentially it is the percentage of stocks that have buy or sell signals. Like many of the market internal indicators, it is used both to confirm a move in the market and as a non-confirmation and therefore divergence indication. If the market is weak and heading down, the BPI should also be moving lower as more and more stocks are sold off.

Nasdaq stocks have been leading the stock market higher since the post-Brexit crash. As evidenced in the chart below, the Nasdaq Composite Bullish Percentage Index (BPCOMPQ) started breaking down in the middle of October to confirm the current overall market weakness. Just as these shares have led the market higher, if they continue faltering this will probably signal the next significant price pullback.

Similar to the BPCOMPQ Index above, the S&P 500 Bullish Percentage Index BPSPX is in freefall. In fact the S&P 500 Index dropped to its lowest level since early July. That’s three months of gains have been wiped out since the index recorded all-time highs in mid-August. There is a lot of room for stocks to keep falling depending on who wins the presidential election and what the FOMC decides to do at their December meeting.

Leave A Comment