The trade on a rangebound United States Oil (USO) is now failing (see “The Commodities Crash Accelerates: Scenarios for Trading Oil” for a description). Oil has continued its collapse past the historic 2009 lows and has helped to drive USO to fresh all-time lows.

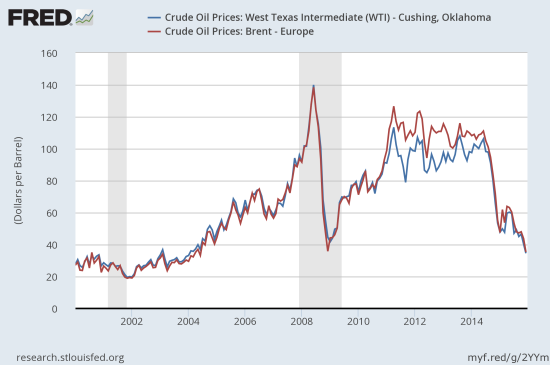

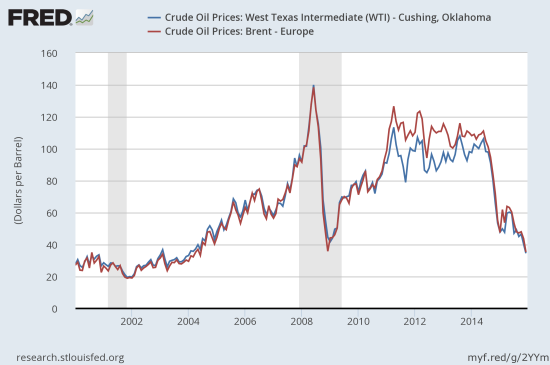

Oil prices continue to collapse.

Source: US. Energy Information Administration, Crude Oil Prices: West Texas Intermediate (WTI) – Cushing, Oklahoma [DCOILWTICO], retrieved from FRED, Federal Reserve Bank of St. Louis, December 24, 2015. US. Energy Information Administration, Crude Oil Prices: Brent – Europe [DCOILBRENTEU], retrieved from FRED, Federal Reserve Bank of St. Louis, December 24, 2015.

The United States Oil ETF (USO) bounced this week off all-time lows.

Source: FreeStockCharts.com

Looking at the chart of oil makes me realize why some oil bears are growling about oil’s potential to hit $20. Such a plunge would mark a complete reversal of the bull run that launched after the recession of the early 2000s ended and was confirmed when the U.S. attacked Iraq in 2003 under the cover of a search for weapons of mass destruction (WMDs). It is even possible to think of oil as a bursting bubble where profits were artificially manufactured and inflated first by the OPEC cartel, next by financial speculation, and finally by over-leveraged speculators in the form of frackers and wildcatters who thought they could rely on Saudi cooperation and capitulation to their production. The importance of oil as a sign of economic strength is so ingrained that even as consumers enjoy rock-bottom prices for gasoline, financial markets lament how much harder it has become to make money from selling oil. The irony of course is that the S&P 500 (SPY) is still trading near all-time highs, so oil’s plunge has not (yet?) truly hurt the stock market in aggregate.

For retail investors and traders, USO is one of the only ways to trade directly on the price of oil. The method of rolling futures means that trading USO is most effective as a bet on short-term price changes. Another viable approach involves selling options on USO. The trade on a rangebound USO relies on selling options. With the current failure in the trade, I made changes this week while implied volatility in USO remains elevated (meaning options on USO, especially puts, also carry a heavier than usual premium).

Leave A Comment