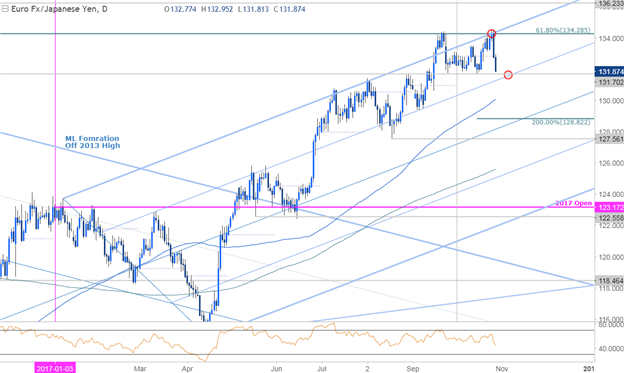

EUR/JPY Daily Chart

Technical Outlook: EUR/JPY turned from a key resistance confluence this week at 134.29– a level defined by the 61.8% retracement of the late-2014 decline, the September high-close and slope resistance. The subsequent decline has taken out the October open with price now approaching the monthly opening-range low at 131.70. Note that the 50-line of the ascending pitchfork rests just lower around ~131.20/30– a break below would suggest a more significant near-term high is in place with such a scenario targeting the 100-day moving average at ~130 and a measured move of the double top formation which converges at the median-line at 128.82.

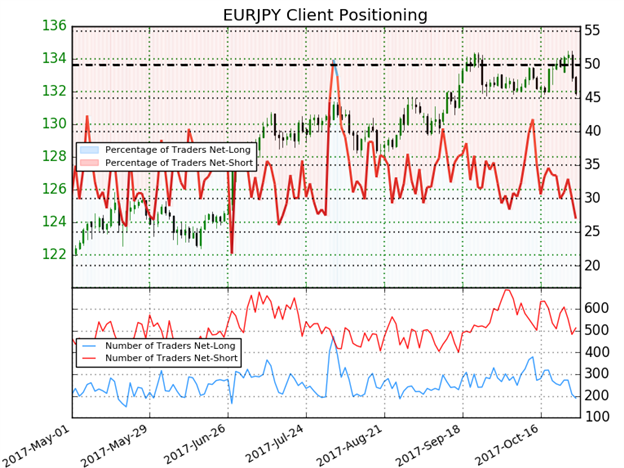

EUR/JPY 240min

Notes:A closer look at price action highlights a near-term descending pitchfork formation with the pair breaking below the median-line in overnight trade. The focus remains lower below this threshold with support initial support targets at 131.71 backed by the lower parallel (currently just above the 131-handle) and the 2016 open at 130.69.

Look for interim resistance along the median-line (currently ~132.60s) backed by 133.10. Broader bearish invalidation stands at 133.48. A topside breach above 134.29 would be needed to shift the focus higher targeting 136.23. Bottom line: from a trading standpoint, I’ll favor selling rallies while within this formation targeting a break of the monthly opening rage lows.

Leave A Comment