J. M. Smucker (SJM), the powerhouse name behind Folgers coffee, specialty jams, oils and other related foods, as well as pet snacks, has just reported its Q3 earnings. It is our opinion that the results we are seeing from the company, in conjunction with the benefits of tax reform, the stock is becoming very compelling at present levels, although we would like to acquire it cheaper if possible.

Price action

Ultimately, the question is, can we buy the recent rally in shares here? The stock is in the middle of a 52-week range:

Source: Yahoo Finance

J.M. Smucker shares are currently trading at $124.55. The stock has rallied off its lows but is still 20 points off its highs last year. So, what is going on here?

Sales are on the rise again

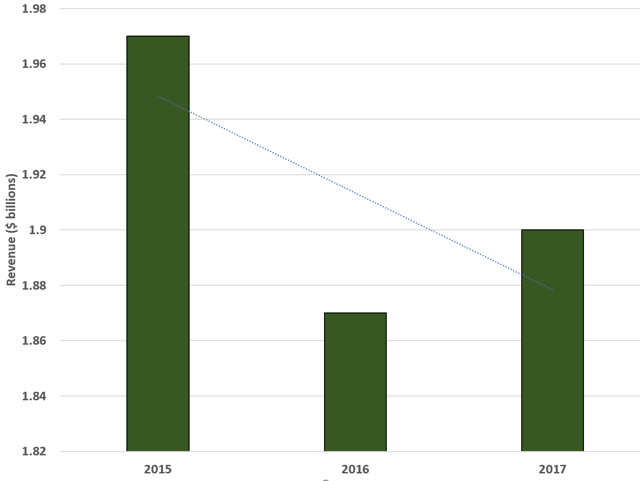

Well, as you can imagine, the recent rally has been driven by the company surpassing estimates on both the top and bottom lines. Let us first discuss what we are seeing on the sales front, and the trends we are seeing in the last few Q3s:

Source: SEC filings

Well, there has been significant pressure here. Net sales decreased $24.5 million, or 1% from last year. They came in at $1.903 billion, versus $1.878 billion last year. Further, beat estimates, albeit only slightly, by $10 million.

What drove sales increases?

The change in net sales was driven by favorable volume and mix issues in several categories. Overall, there was a 1 percentage point impact from the more favorable volume/mix. The largest positives were seen in pet food and coffee, partially offset by declines in the oils. Pricing slightly offset the impact of the favorable mix. These sales trends reflect a turnaround from earlier in the year where J. M. Smucker was seeing weakness in coffee and oil. Within coffee, the K-cups brands have performed well ahead of expectations, growing 3% in the quarter, well above our expectations.

Expenses could be better managed

With the increase in sales, we were hopeful that expense management would lead to better than expected profits. Sales were up 1% but the costs of products rose 2% to $1.174 billion. That rise is a bit higher that we would like, but gross profit still expanded. Gross profit grew to $728.5 million, up from $722.9 million. That said, gross profit margins fell down to 38.3%, from 38.5% last year. Factoring in changes in project costs, selling and administrative expenses and amortization, we see operating income dropped 20% to $162.7 million. That is not a recipe for a winning stock run, as reported. However, making needed adjustments for special items, operating income actually rose 4%, reversing a trend of weakness.

Leave A Comment