A central theme of Bank of America’s equity analysis this year has been the ‘melt-up’ trade.

At the beginning of the year, Michael Hartnett, BAML’s chief investment strategist, wrote in a note to clients that “Our tactical view: after a January/February wobble, we believe stocks & commodities will have one last 10% melt-up in [the first half of the year].”

Hartnett named this the “Icarus trade”:

“Call it the Icarus trade. The current melt up, which started back in Feb 2016, will be followed by a meltdown later in 2017.”

As we near the end of the year, it seems Hartnett was correct about the first half melt-up, but so far, the proposed meltdown has not yet occurred.

And according to analysts at BAML’s Equity Derivatives research arm, it looks as if the meltdown is unlikely to occur anytime soon. Indeed, in a research note published earlier this week, the team believes that investors should use cheap options to capture further upside as extreme Sharpe ratios — a consequence of today’s near-record low volatility and low-interest rates present a great opportunity.

Sharpe Ratios Offer Opportunity With Options

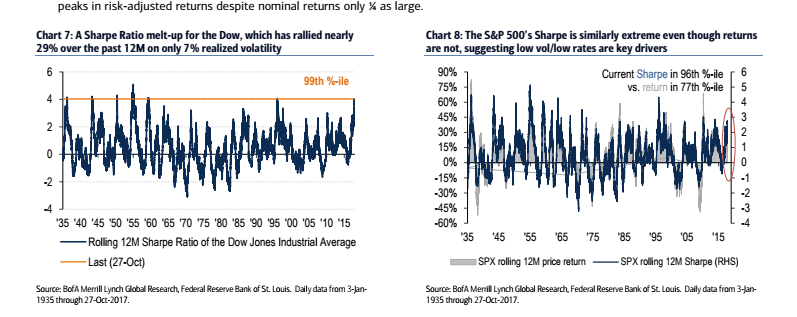

The report notes that today, thanks to record low equity volatility and depressed interest rates, the Sharpe ratio has spiked to abnormal levels. Since 1935, the 12-month Sharpe Ratio of the Dow has been higher only 1% of the time. Similarly, the S&P 500 has recorded a Sharpe of 2.8 over the past 12 months (96th percentile) while generating a relatively pedestrian 12-month return of 21% (77th percentile). Moreover, with a 12-month Sharpe of 2.5, the Nasdaq 100 is approaching Tech Bubble peaks in risk-adjusted returns despite nominal returns only ¼ as large.

“One has to go back to the early-1960s to find a period with (i) Sharpe Ratios exceeding today’s levels, (ii) equity volatility as low or even lower on a sustained basis, and (iii) a gently rising rates cycle.”

And

Sharpe ratios near 80yr extremes

Leave A Comment