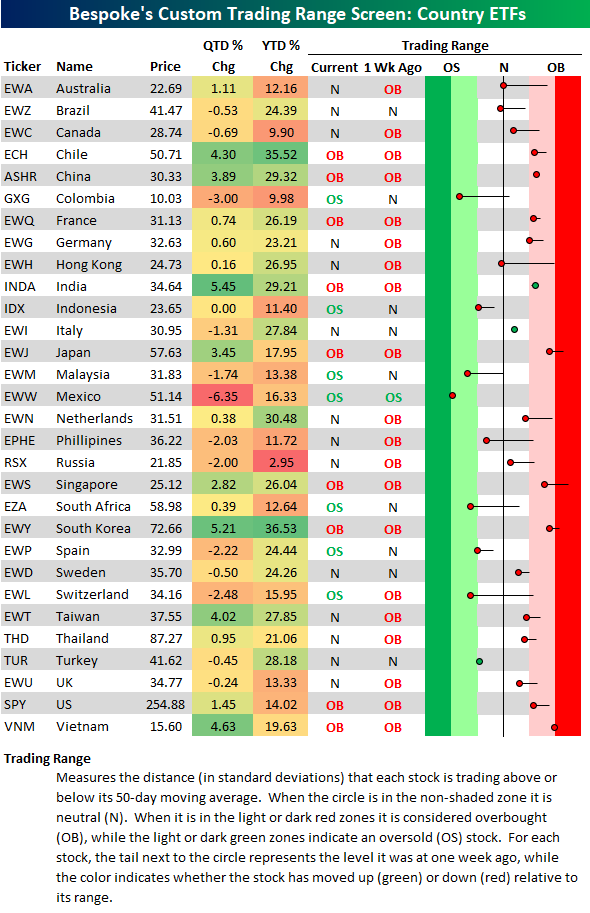

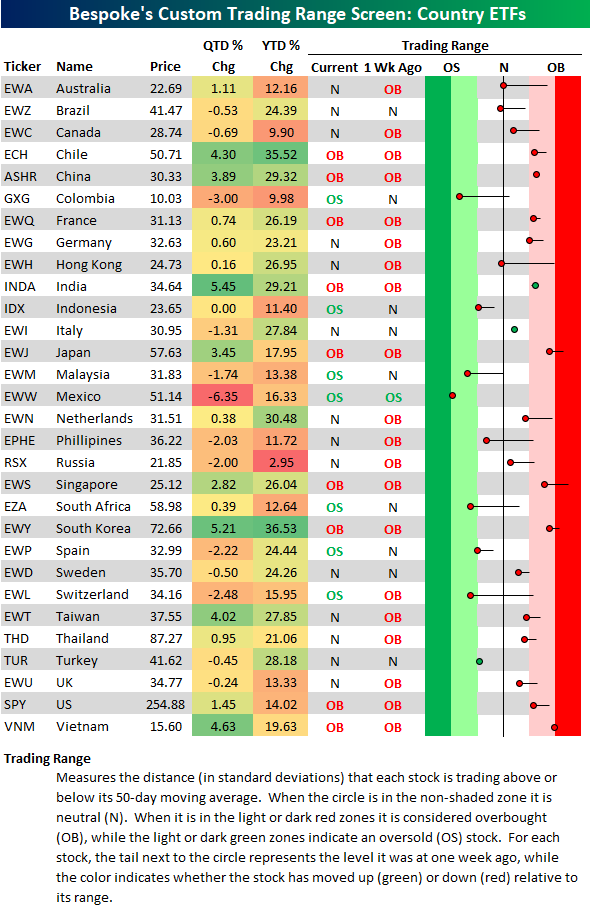

US equity markets have been on a pretty epic run over the past few weeks, but today the major indices are finally pulling back a bit. We’re seeing mean reversion in international equity markets as well. We highlighted each of the 30 largest country ETFs (traded on US exchanges) are trading relative to their 50-day moving averages (the black vertical “N” line in the screen).The dot represents where each ETF is currently trading relative to its range, while the tail end shows where it was trading a week ago.A red dot means the ETF is down within its range over the last week, and vice versa for a green dot.

As you can see, there are only three green dots versus twenty-seven red dots, so we’ve pretty much seen across-the-board mean reversion for global equities over the last week.There were twenty countries that were trading in overbought (OB) territory last week at this time, but now there are only nine.And there are now seven countries in oversold territory versus just one last week.

Countries like Australia (EWA), Brazil (EWZ), Colombia (GXG), Hong Kong (EWH), the Philippines (EPHE), South Africa (EZA), and Switzerland (EWL) all broke below their 50-days over the last week.

Leave A Comment