Freeport-McMoRan Inc. (FCX – Free Report) is a mining giant that is primarily engaged in mineral exploration and development, mining and milling of copper, gold, molybdenum and silver, as well as the smelting and refining of copper concentrates.

Freeport is taking actions to manage costs and capital spending amid a still challenging operating environment. The company also remains focused on de-leveraging its balance sheet, partly through assets sale.

Let’s have a quick look at this mining behemoth’s third-quarter release.

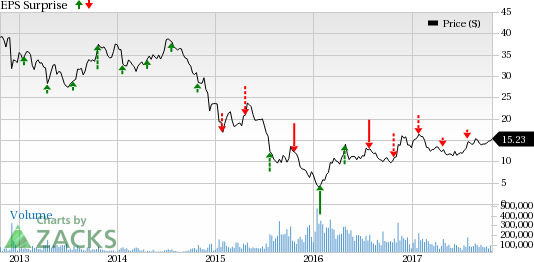

Estimate Trend & Surprise History

Estimate for Freeport for the third quarter has been going up over the past month. The company has missed the Zacks Consensus Estimate in all the trailing four quarters with an average negative surprise of 20.1%.

Earnings

Freeport reported adjusted earnings of 34 cents per share for the quarter, beating the Zacks Consensus Estimate of 29 cents.

Freeport-McMoran, Inc. Price and EPS Surprise

Freeport-McMoran, Inc. Price and EPS Surprise | Freeport-McMoran, Inc. Quote

Revenues

Freeport posted revenues of $4,310 million, surpassing the Zacks Consensus Estimate of $4,104.1 million.

Key Stats/Developments to Note

At the end of the third quarter, Freeport’s total debt was $14.8 billion. For 2017, the company expects operating cash flows and capital expenditures to be around $4.3 billion and $1.5 billion, respectively.

Freeport anticipates sales volumes for 2017 to be roughly 3.7 billion pounds of copper, 1.6 million ounces of gold and 94 million pounds of molybdenum, including 1 billion pounds of copper, 625,000 ounces of gold and 23 million pounds of molybdenum for fourth-quarter 2017.

Freeport had no borrowings with $3.5 billion available under its revolving credit facility at the end of the reported quarter.

Zacks Rank

Currently, Freeport has a Zacks Rank #2 (Buy).

Market Reaction

Freeport’s shares were up 2.5% in the pre-market trading following the release. It would be interesting to see how the market reacts to the results during the trading session today.

Leave A Comment