What I know about software these days ain’t much. I’m often caught staring slack-jawed while folks around me prattle on about the capabilities of this application or that package. About technology, I know only of generalities. And darn few of those.

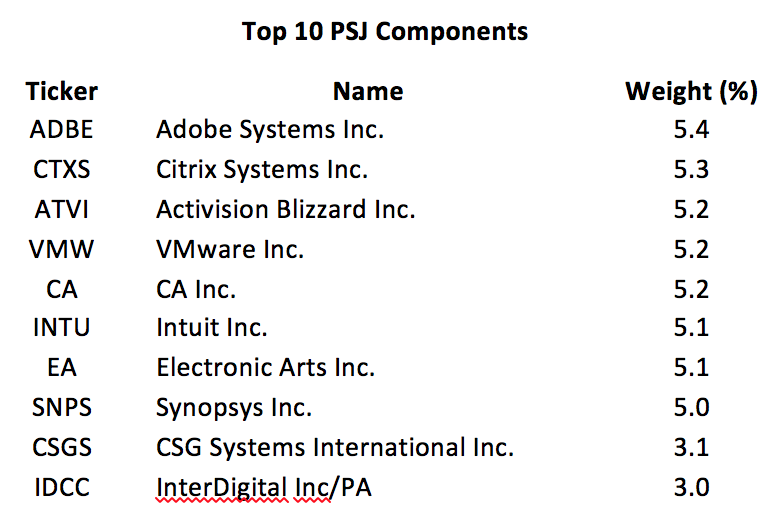

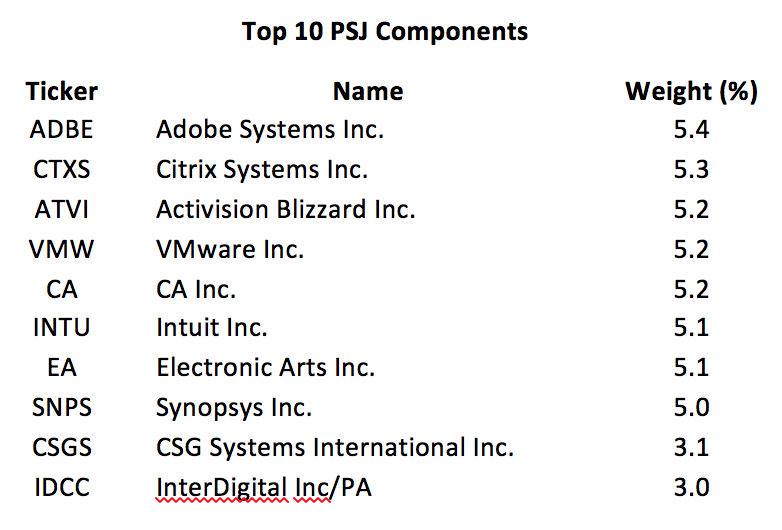

Luckily, I don’t need to know much tech to profit from software. There are plenty of ways to invest in the stuff for monetary gain. One way is through the PowerShares Dynamic Software Portfolio ETF (NYSE Arca: PSJ), an exchange-traded fund that uses a quantitative model to select an eclectic mix of software companies.

PSJ tracks the Dynamic Software Intellidex Index which aims to outperform more conventional indices by filtering its universe for companies exhibiting price and earnings momentum, along with other quality and management metrics. PSJ’s methodology draws in companies from all capitalization tiers, ultimately tilting its portfolio toward the small side. Its largest allocation—36 percent— is to small-cap growth stocks. PSJ isn’t parochial, either. A fair chunk of its investments are healthcare technology companies.

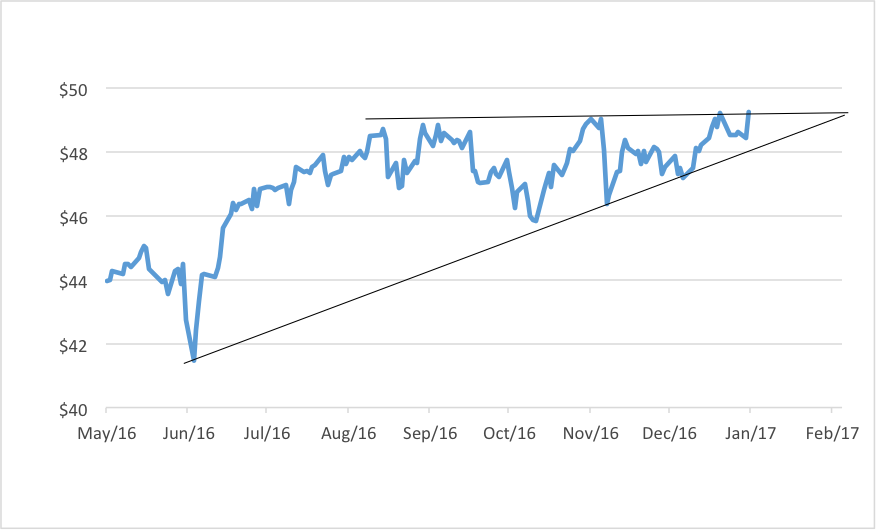

So what makes PSJ—at 63 basis points (.63 percent) a rather expensive exposure—so special? A breakout move, that’s what. See the chart below?

That triangular pattern inscribed by PSJ’s recent highs and lows over the past seven months is a bullish pattern leading to Tuesday’s break above $49. That blip, if sustained, sets up a run to a significantly higher level.

How high? Judging from the depth of the formation, ultimately to $56. The momentum built up since June is a lever with the power to propel prices 14 to 15 percent higher.

I only wish it could make me 15 percent more tech savvy.

Leave A Comment