Corporate executives now shy away from capital spending. Companies are spending money to cut costs—labor cost especially, and also electricity—but few companies are increasing productive capacity.

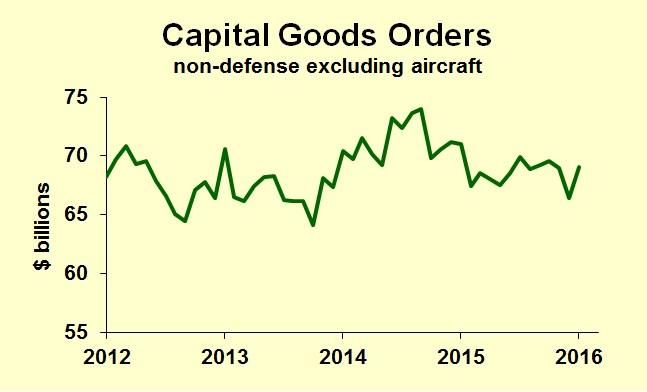

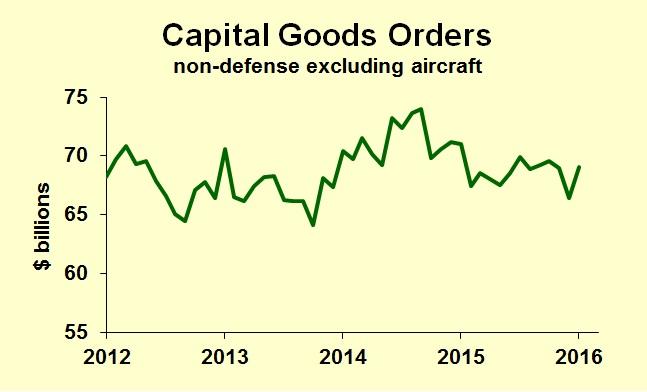

Total manufacturing capacity has grown by just over one percent in the past year, despite larger gains in the overall economy. The latest report on orders for non-defense durable goods excluding aircraft, the standard gauge for business capital spending, shows a rebound last month but a moribund trend. Why aren’t businesses buying the machinery and computers that will enable future growth?

A good bit of the recent decline comes from the petroleum industry. We don’t have statistics on capital goods orders by customers, but we can infer a good bit. The category “primary metals” has fallen the most; this includes the pipe used both in drilling and in transportation. Machinery purchases have also dropped, and some of this decline comes from petroleum.

But the fall in oil and gas prices is just part of the story. As I talk to business leaders, most of them do not expect unit sales to increase much in the coming years. Corporations are flush with cash—a record high, in fact. Interest rates are tiny for those who would borrow to finance capital expenditures. Profits have declined, but from a strong level in 2014.

Where businesses spend money is mostly on cost-cutting. Computer expenditures are up, helping to make workers more productive—and reduce the need for more workers.Energy savings had motivated much capital spending until oil and natural gas prices dropped, but electricity is still expensive, so there’s some spending on energy saving.

When I look at the opportunities for expansion in the overall economy I keep coming back to capital spending. I’ve been surprised by corporate executives’ lack of optimism about future sales; now I have accepted that, and I’m just disappointed. Some pundits blame political uncertainty, but capital goods orders did not fall in most election years past—2008 being the greatest exception.

Leave A Comment