Gold edged up on Monday, marking the first rise in nine trading sessions, as the market took a breather after tumbling to a three-month low on Friday. Last week’s strong jobs report rekindled bets the Federal Reserve will deliver a rate hike next month. The XAU/USD pair traded as high as $1095.67 an ounce before pulling back to the $1093 level.

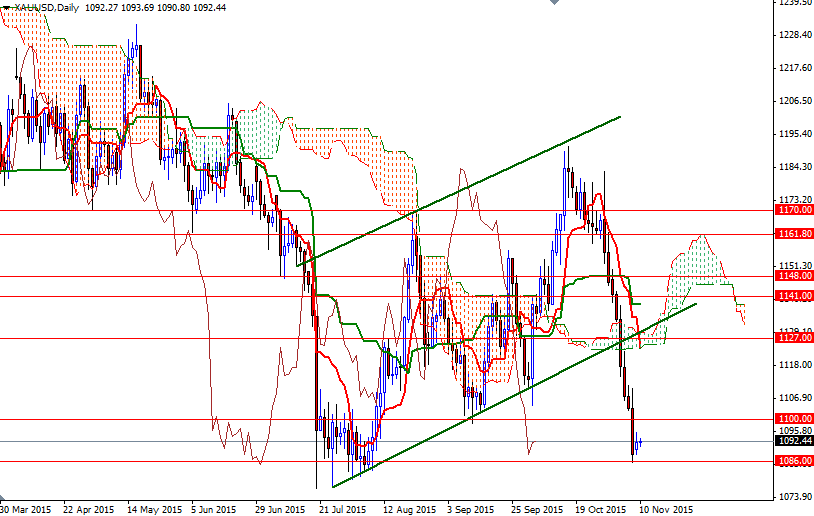

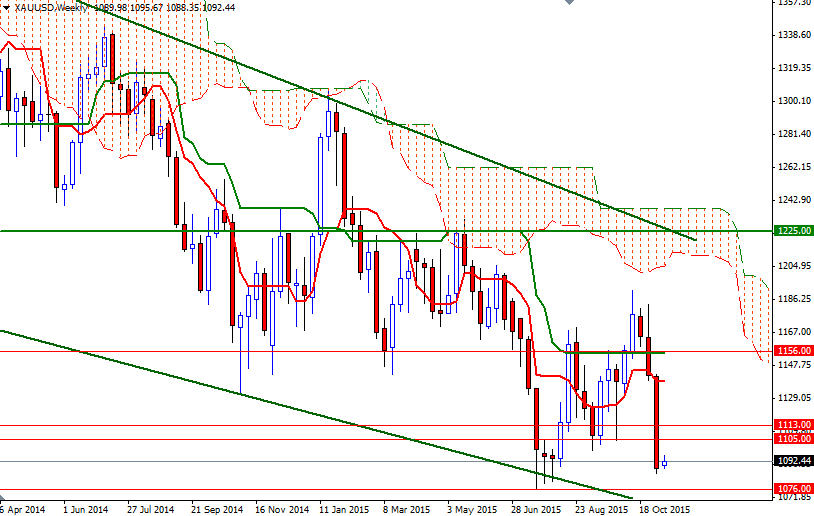

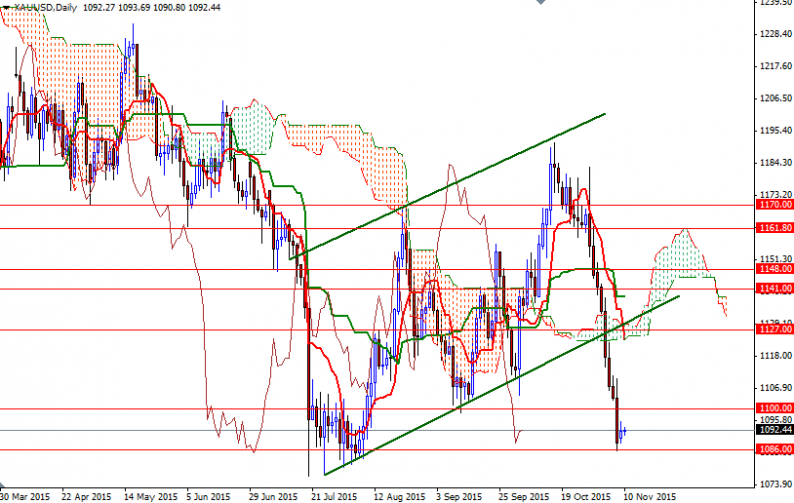

From a technical perspective, trading below the Ichimoku clouds on the weekly and daily charts suggest that the broader directional bias remains weighted to the downside. Basically, the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. Gold’s steep fall and the fact that it struggle to move away from the current lows reflect a sustained pressure.

However, apparently the bearish side of the boat is overcrowded at the moment and therefore prices may tend toward consolidation – between the 1105 level on the top, and the 1082 level on the bottom. The initial resistance level now stands at 1096, followed by 1100. I think a break above this level would give the bulls the extra power they need to visit 1105. A daily close above 1105 could increase the possibility of an attempt to visit the 1113/0 area. To the down side, the bears will have to drag the XAU/USD pair below the 1086/2 zone in order to increase pressure. If that support gives way, it is possible to see a bearish continuation to the next key support in the 1076/4 region.

Leave A Comment