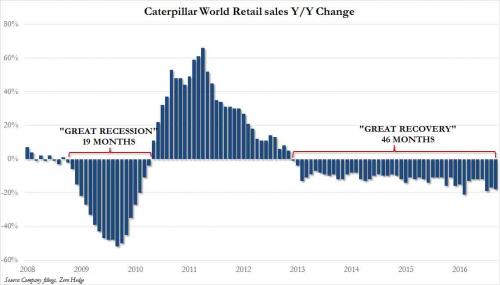

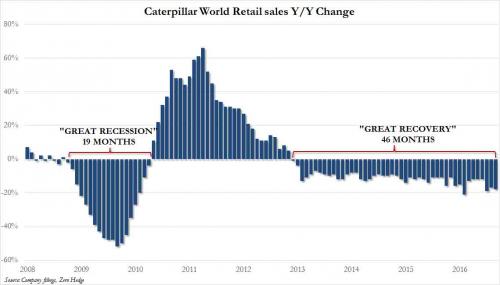

As we previewed yesterday when we showed that for 46 consecutive months industrial bellwether Caterpillar (CAT) has failed to post a retail sales increase…

… it should probably not come as a surprise that moments ago CAT not only badly missed revenues, reporting $9.2 billion well below the $9.80 billion expected (courtesy of the usual non-GAAP fudging, CAT managed to “boost” its EPS enough to beat estimates, reporting adjusted earnings of $0.85, above the $0.76 consensus), but it also once again slashed full year guidance, now expecting revenue of $39 billion, and EPS of $3.25 per share excluding restructuring costs, down from the guidance of $40.0 to $40.5 billion and EPS of $3.55 provided just three months ago.

But it was outgoing CEO Doug Oberhelman’s commentary in the release that was more troubling, to wit:

“Economic weakness throughout much of the world persists and, as a result, most of our end markets remain challenged. In North America, the market has an abundance of used construction equipment, rail customers have a substantial number of idle locomotives, and around the world there are a significant number of idle mining trucks.”

x

“While we are seeing early signals of improvement in some areas, we continue to face a number of challenges. We remain cautious as we look ahead to 2017, but are hopeful as the year unfolds we will begin to see more positive momentum. Whether or not that happens, we are continuing to prepare for a better future. In addition to substantial restructuring and significant cost reduction actions, we’ve kept our focus on customers and on the future by continuing to invest in our digital capabilities, connecting assets and jobsites and developing the next generation of more productive and efficient products”… “Many of our businesses, including mining, oil and gas, rail and construction, are currently operating well below historical replacement demand levels in many parts of the world.”

Leave A Comment