There was a spread of action between bulls and bears, but no big change for any index. The Nasdaq and Russell 2000 had the best of the action, but it was little more than a half-hearted follow through of Friday’s gain.

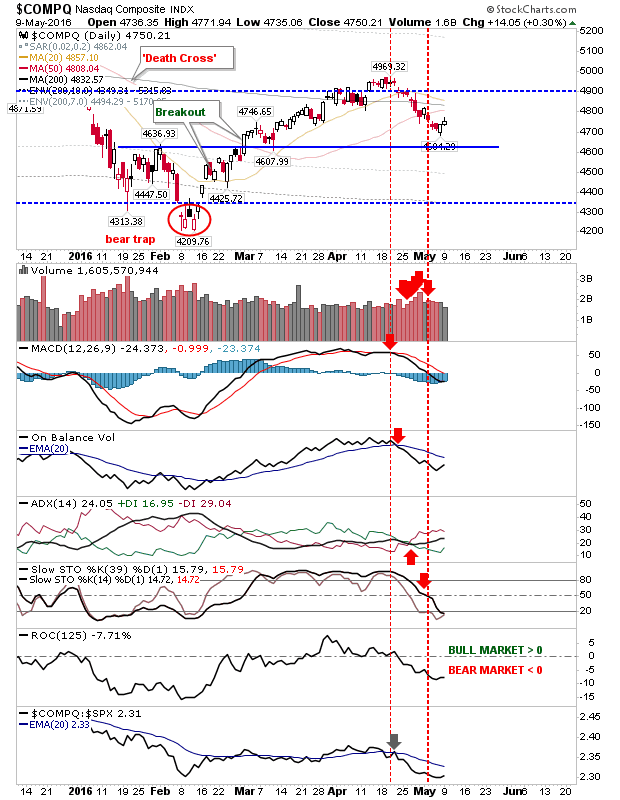

The Nasdaq wasn’t able to hold on to the highs of the day, closing in the middle of today’s high/low range. Technicals are bearish, and trading volume was light.

The Russell 2000 in its gain touched former support turned resistance of the rising channel. The 200-day MA is also playing as resistance. Technicals are mixed. Stochastics [39,1] are at an ideal ‘buy’ point, along with bullish outperformance against the Nasdaq.

Large Caps were muted. How will Friday’s swing low play out as a trade-worthy low, or will it turn into a reversal head-and-shoulder pattern.

The Semiconductor Index is holding on to its 200-day MA with a low key doji. 615 is looking a more probable test, but while the 200-day MA is been defended it has to be respected as lead support. Friday’s hammer does have the look of a trade-worthy low.

For Tuesday, bulls will need to turn up the heat if Friday’s lows are to be the swing low for markets. The easier path looks down and the risk:reward favours bears, but bulls could benefit in the near term.

Leave A Comment